Islamic Halal Account FxPro Pakistan

Access FxPro’s Islamic Halal account in Pakistan. Trade forex and CFDs with zero swap fees following Sharia principles. Open your account today.

Understanding Islamic Halal Trading Accounts

What is Islamic Halal account in FxPro reflects our dedication to providing Sharia-compliant trading options for Muslim traders in Pakistan. These accounts remove any interest-based charges, such as overnight swaps, to comply with Islamic law. We ensure that our clients trade with identical conditions to standard accounts except that no swaps are applied on positions held overnight.

Our Islamic accounts are verified by qualified Islamic scholars to guarantee compliance with Sharia rules. Pakistani traders benefit from access to major currency pairs, commodities, indices, and CFDs on a swap-free basis. We support all FxPro platforms including MT4, MT5, and cTrader with fast and reliable trade execution.

| Feature | Islamic Account | Standard Account |

|---|---|---|

| Overnight Swaps | Zero | Variable rates |

| Minimum Deposit | $100 USD | $100 USD |

| Spreads | From 1.2 pips | From 1.2 pips |

| Execution Speed | 0.03 seconds | 0.03 seconds |

| Available Instruments | 70+ pairs | 70+ pairs |

Sharia Compliance Verification Process

Our Islamic accounts undergo regular assessment by certified Islamic finance experts. The verification includes quarterly audits of fee structures and trading conditions. We maintain detailed documentation aligned with Murabaha and Musharaka principles to ensure ongoing Sharia adherence.

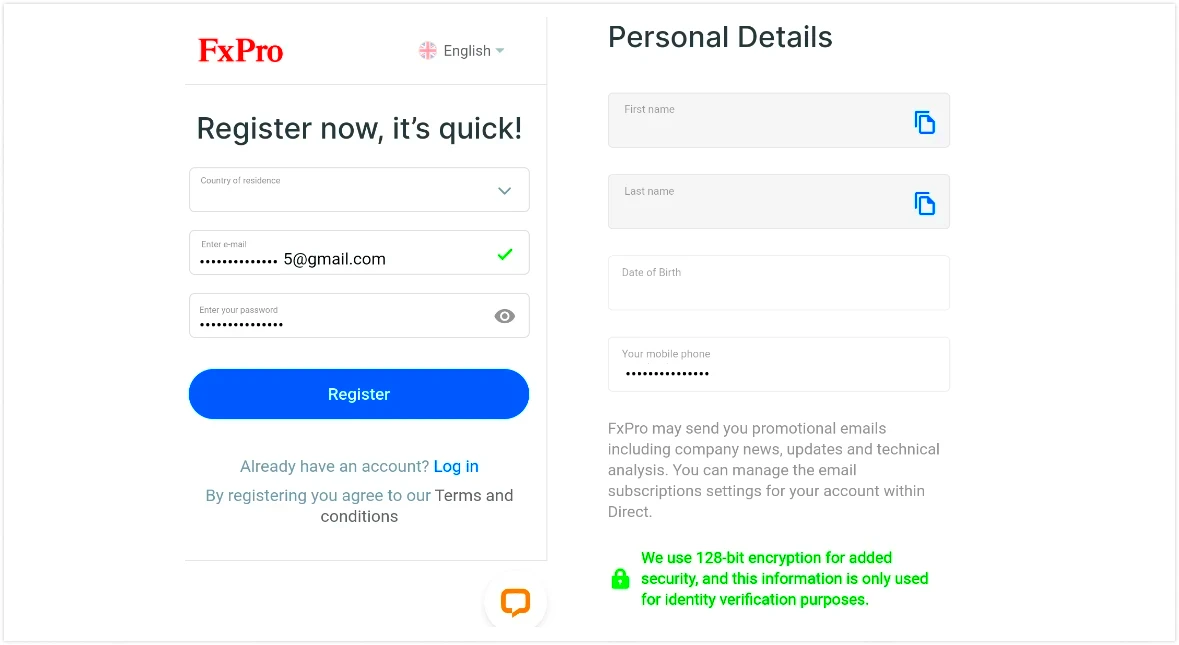

Opening Your Islamic Account in Pakistan

Pakistani residents can register for an Islamic account easily via our website. Select “Islamic Account” during the signup process and provide your CNIC along with proof of address. The system recognizes Pakistani IPs and displays Pakistani Rupee (PKR) as the currency option.

After uploading required documents, verification takes 24 to 48 hours. Once approved, you receive credentials to access MT4, MT5, or cTrader platforms. We offer platform tutorials in English tailored for Pakistani users to facilitate smooth onboarding.

Required Documentation for Pakistani Traders

- Clear photos of CNIC front and back

- Recent utility bill or bank statement with Pakistani address

- Live selfie holding CNIC for identity verification

Account Funding Methods for Pakistan

We accept deposits through bank wire transfers from Pakistani banks such as HBL, UBL, and MCB. Debit and credit cards (Visa, Mastercard) are accepted with monthly limits of $2,000. Skrill and Neteller provide instant deposit options and are widely used in Pakistan.

Trading Instruments Available

Our Islamic accounts grant access to over 70 currency pairs, including majors like EUR/USD and GBP/USD, along with exotic pairs involving PKR. Commodities such as gold, silver, and crude oil are available without swap fees. We also offer CFDs on global indices and stocks, plus cryptocurrency CFDs.

We exclude any instruments linked to interest-based earnings or prohibited sectors. Our halal screening is updated quarterly to maintain strict adherence to Islamic principles.

- Major currency pairs (EUR/USD, GBP/USD, USD/JPY, AUD/USD)

- Minor pairs with PKR crosses (USD/PKR, EUR/PKR, GBP/PKR)

- Precious metals (Gold, Silver, Platinum, Palladium)

- Energy commodities (Crude Oil, Natural Gas, Heating Oil)

- Agricultural products (Wheat, Corn, Soybeans, Coffee)

- Global stock indices (S&P 500, FTSE 100, DAX 30, Nikkei 225)

- Individual stock CFDs from major exchanges

- Cryptocurrency CFDs (Bitcoin, Ethereum, Litecoin)

Halal Screening Criteria

We exclude companies earning more than 5% from prohibited activities like gambling or conventional banking. Financial ratios such as debt-to-equity limits are applied in selection. The halal instruments list is reviewed quarterly by our Sharia board.

Platform Features and Tools

Our Islamic MT4 platform supports Expert Advisors compatible with swap-free trading. Features include real-time quotes, advanced charting with over 50 technical indicators, and one-click trade execution. Mobile apps for Android and iOS enable full Islamic account access on the go.

MT5 enhances order management, supporting partial fills and advanced pending orders. The integrated economic calendar highlights market events affecting halal instruments. Depth of Market (DOM) functionality shows real-time order book data for liquidity insight.

| Platform | Key Features | Mobile App | Expert Advisors |

|---|---|---|---|

| MT4 | 50+ indicators, EAs | Yes | Unlimited |

| MT5 | Advanced orders, DOM | Yes | Unlimited |

| cTrader | cBots, Social trading | Yes | Custom algorithms |

Risk Management Tools

We offer negative balance protection to prevent deficits during market swings. Stop-loss and take-profit orders trigger automatically without manual input. Margin call alerts notify traders when equity drops below 50% of margin requirements.

Educational Resources

Our webinars in English cover Islamic trading principles and platform usage for Pakistani traders. Video tutorials and market analyses support informed decision-making aligned with Sharia compliance.

Account Types and Specifications

Islamic MT4 accounts feature fixed spreads from 1.2 pips with no commissions. Maximum trade size is 500 standard lots. Leverage is capped at 1:30 for major pairs and 1:20 for exotics according to regulations.

Islamic MT5 offers variable spreads starting at 0.8 pips with $3.50 commission per lot, optimized for scalping. Leverage remains 1:30 on majors and 1:10 on stock CFDs. Our cTrader Islamic account provides ECN execution with spreads from 0.4 pips plus commissions and direct market access.

- Islamic MT4 Fixed: 1.2 pips spread, no commission, 1:30 leverage

- Islamic MT5 Variable: 0.8 pips spread, $3.50 commission, faster execution

- Islamic cTrader ECN: 0.4 pips spread, $3.50 commission, DMA access

- Islamic Demo: virtual funds, unlimited duration

- Islamic VIP: enhanced conditions, dedicated support, $25,000 minimum deposit

Leverage Specifications

We offer leverage up to 1:30 for major currency pairs. Exotic pairs have maximum leverage of 1:20. Commodity CFDs like gold and oil have leverage limits set at 1:10 for risk control.

Swap-Free Trading Mechanics

What is Islamic Halal account in FxPro removes interest (riba) by zeroing overnight swaps. Instead, administrative fees apply only to positions held beyond seven days. This maintains Sharia compliance while covering operational costs.

Fees are calculated based on position size and instrument, remaining lower than conventional swap charges. All currency pairs, commodities, and CFDs are eligible for this swap-free structure. The platform clearly displays “Swap-Free” status on Islamic accounts.

| Position Duration | Administrative Fee | Standard Swap |

|---|---|---|

| 1-7 days | Zero | Variable daily |

| 8-30 days | 0.01% per week | Variable daily |

| 31+ days | 0.02% per week | Variable daily |

Fee Calculation Examples

A $10,000 EUR/USD position held for 10 days incurs a $1.00 administrative charge. Gold positions held beyond seven days carry weekly fees of 0.01%. Our fee calculator tool shows exact costs before trade confirmation.

Customer Support for Pakistani Traders

Our customer support team is available 24/5 during trading hours, offering live chat responses within 60 seconds. Support is provided in English with specialists knowledgeable in Islamic finance and Sharia compliance. Pakistani traders can reach us via local phone numbers, toll-free international lines, and email.

Dedicated relationship managers assist Islamic account holders with deposits over $10,000, providing personalized guidance and strategy advice. Support also includes WhatsApp business messaging and scheduled video consultations for complex queries.

- Live chat support (24/5, under 60 seconds)

- Pakistani local phone support (+92-21-XXXXXXX)

- International toll-free numbers

- Email support (4-hour response guarantee)

- Dedicated relationship managers (for $10,000+ accounts)

- WhatsApp business support

- Video call consultations

- On-site support in Karachi and Lahore (premium accounts)

Islamic Finance Expertise

Our team includes certified Islamic finance consultants who advise on halal trading strategies. They guide Pakistani traders through Sharia-compliant investment decisions ensuring alignment with religious principles.

Technical Support Services

We provide remote assistance for platform installation, EA setup, and custom indicators. Video tutorials cover common technical questions and platform optimization techniques to enhance trading efficiency.

Regulatory Compliance and Security

FxPro operates under multiple international licenses protecting Pakistani traders. Our Islamic accounts meet both Sharia and financial regulatory standards. Client funds are held in segregated tier-one banks, separate from company assets.

We utilize 256-bit SSL encryption to safeguard data transmission and enforce two-factor authentication for account access and withdrawals. Regular security audits and penetration tests ensure system integrity.

| Security Feature | Implementation | Benefit |

|---|---|---|

| SSL Encryption | 256-bit | Data protection |

| 2FA Authentication | SMS/App based | Account security |

| Fund Segregation | Tier-1 banks | Client protection |

| Compensation Scheme | €20,000 coverage | Financial security |

Data Protection Measures

We comply with GDPR and related data privacy standards. Pakistani client information remains confidential and is never shared without consent. Our data centers offer 99.9% uptime with redundant backup systems.

The Islamic Halal account solution by FxPro offers Pakistani traders a swap-free, Sharia-compliant gateway to global markets. Our platform technology, support, and regulatory safeguards provide a seamless halal trading experience.

❓ FAQ

What is Islamic Halal account in FxPro?

It is a swap-free trading account designed to comply with Sharia law by eliminating interest charges on overnight positions.

How can Pakistani traders open an Islamic account?

Pakistani users register online, submit CNIC and proof of address, and complete verification to activate their Islamic account.

Which platforms support Islamic Halal accounts?

FxPro offers Islamic accounts on MT4, MT5, and cTrader with full features and swap-free conditions.

Are there any fees for holding positions overnight?

Positions held longer than seven days incur a low administrative fee instead of swaps, maintaining Sharia compliance.

What payment methods are available for Pakistani traders?

Pakistani clients can fund accounts via local bank transfers, international cards, Skrill, and Neteller.