How to Verify FxPro Account in Pakistan

Verify your FxPro trading account in Pakistan with Pakistani CNIC, address proof, and mobile verification. Fast 24-48 hour approval process.

Overview of FxPro Account Verification in Pakistan

Account verification is a mandatory step for all FxPro clients residing in Pakistan. Our company enforces strict verification protocols to comply with Pakistani financial laws and international anti-money laundering standards. This process safeguards both our platform and Pakistani traders from unauthorized activities. To access live trading features, Pakistani users must provide valid identification, proof of residence, and complete mobile verification. Verification requests are typically processed within 24 to 48 hours on working days.

The submitted information undergoes validation against official Pakistani government databases. FxPro accepts documents in both English and Urdu to accommodate Pakistani clients. We support multiple types of documents and allow flexible submission formats suitable for various client needs across Pakistan.

| Document Type | Accepted Formats | Processing Time | Requirements |

|---|---|---|---|

| Pakistani CNIC | Front and back photos | 24 hours | Clear, unedited images |

| Proof of Address | Utility bills, bank statements | 24 hours | Issued within 3 months |

| Mobile Verification | SMS code | Instant | Pakistani mobile number |

Our verification system uses advanced technology to check authenticity and prevent fraud. Clients in Pakistan benefit from a fast and secure approval mechanism enabling timely access to trading.

Required Documents for Pakistani Account Verification

Before starting the verification, Pakistani clients should prepare valid documents. The primary identification is the Pakistani Computerized National Identity Card (CNIC). Ensure the CNIC images are clear and display all text and photos properly. Address proof must be current and reflect your residential address in Pakistan. Accepted documents include utility bills from local providers and bank statements from major Pakistani banks.

- Pakistani CNIC front and back photos with no edits

- Utility bills from K-Electric, SNGPL, SSGC, or PTCL

- Bank statements from HBL, UBL, MCB, or Allied Bank

Matching names and addresses between documents are essential for smooth verification. Documents must be recent and issued within the last three months.

CNIC Requirements and Specifications

The Pakistani CNIC must be submitted as high-quality front and back images. Our platform requires that all four corners of the card are visible without cropping. Photographs should be free from glare or shadows to ensure legibility. The CNIC number is cross-checked with NADRA databases for validation. Expired or altered CNIC images will be rejected automatically.

Address Proof Documentation Standards

Address verification requires documents issued in the last three months. Utility bills from recognized Pakistani providers must clearly show your full name and residential address. Bank statements should include transaction details along with your registered address. Exact name matching with your CNIC is necessary to avoid verification delays. We accept both physical and electronic copies provided they meet quality standards.

Step-by-Step Account Verification Process

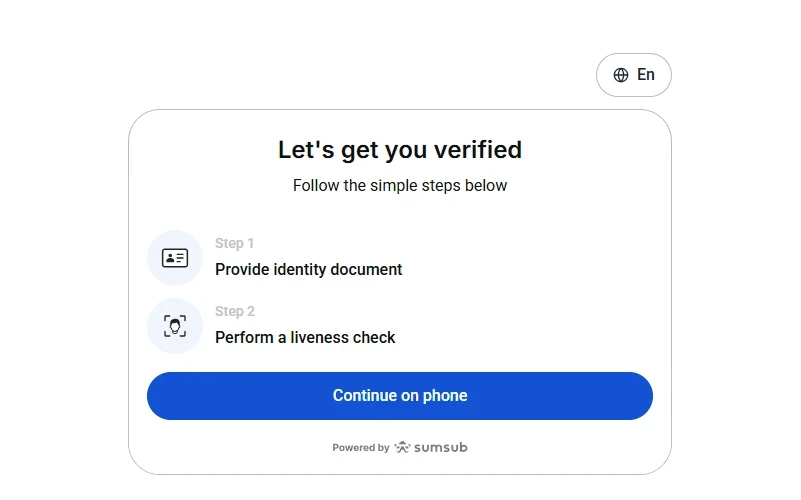

To verify your FxPro account, log in to the FxPro Direct dashboard via our website or mobile app. Navigate to the Profile section and select “Verify Your Identity.” Our platform will guide you through the necessary steps in sequence. First, upload front and back images of your Pakistani CNIC, ensuring optimal photo quality. Next, upload your proof of address by selecting the document type from the dropdown menu before submission.

- Access FxPro Direct and open Profile

- Choose “Verify Your Identity”

- Upload CNIC front and back photos

- Submit recent proof of address

- Complete mobile phone verification

The system provides immediate feedback on image quality and document acceptance. Follow the prompts to correct or retry uploads if needed.

Mobile Phone Verification Process

Enter your Pakistani mobile number including the +92 country code. We send a one-time SMS code to numbers on Jazz, Telenor, Zong, or Ufone networks. The verification code arrives within 60 seconds. Input the code into the designated field on the platform. The code expires after 10 minutes, allowing you to request a new one if necessary. This step completes the identity confirmation process.

Document Upload Technical Requirements

Documents must be uploaded in JPEG, PNG, or PDF formats with a maximum size of 5MB each. Use natural or LED light sources to avoid glare on plastic CNIC cards. Position the document on a flat surface with a contrasting background for clear visibility. Avoid flash photography and ensure all text and images are sharp and legible. Proper upload quality speeds up the verification process and reduces rejections.

Verification Timeline and Processing Status

FxPro processes Pakistani verification requests within 24 to 48 hours on weekdays. Our team works Monday to Friday, 9 AM to 6 PM Pakistan Standard Time. Documents submitted over weekends are reviewed on the next business day. You can monitor your verification progress in real time via the FxPro Direct dashboard under the Profile section. Email alerts notify you when verification completes or if further information is required.

| Verification Stage | Typical Duration | Status Updates | Next Steps |

|---|---|---|---|

| Document Upload | Immediate | Submitted | Await review |

| Initial Review | 4-8 hours | Under Review | No action required |

| Final Approval | 16-24 hours | Approved | Begin trading |

In complex cases, processing may extend up to 5 business days. We contact clients directly for additional document requests or clarifications.

Common Verification Issues and Solutions

Verification delays often stem from poor document quality or data mismatches. Blurry images, expired IDs, or inconsistent names trigger rejections. Our feedback clearly states the reason and required corrective measures. Ensure your registered name exactly matches your Pakistani CNIC spelling. Contact support to update account details if needed.

- Retake and upload clearer document photos

- Verify all personal data matches your CNIC

- Update address in profile to match address proof

Following these steps minimizes verification delays and improves approval chances.

Resolving Document Quality Issues

Resubmit documents captured in well-lit, shadow-free environments. Avoid glare or flash reflections on plastic CNIC cards. Use higher resolution camera settings to improve clarity. Ensure documents are fully visible with no cut edges. These adjustments help meet our platform’s acceptance criteria.

Address Mismatch Resolution

If your registered address differs from your proof of address, update it in the Profile section before resubmission. We accept temporary address changes supported by explanatory documents. Our manual review team evaluates complex cases to verify Pakistani client addresses accurately.

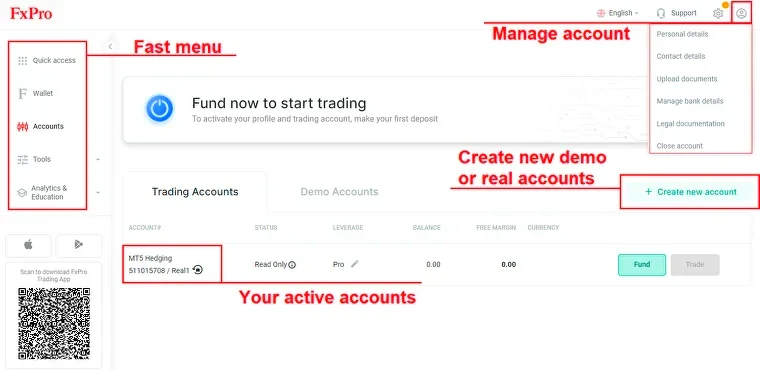

Post-Verification Account Access and Features

After successful verification, Pakistani clients gain access to full trading capabilities. Create live accounts on MT4, MT5, or cTrader platforms through the FxPro Direct dashboard. Choose your account currency, leverage, and preferred trading conditions. Our platform supports forex pairs, commodities, indices, and cryptocurrencies.

| Feature | Details |

|---|---|

| Leverage | Up to 1:500 for forex, 1:100 for CFDs |

| Account Currencies | USD, EUR, GBP, PKR (limited) |

| Trading Instruments | Forex pairs, commodities, indices, cryptocurrencies |

| Deposit Methods | Pakistani bank transfers, credit cards, digital wallets |

| Withdrawal | Available after verification completion |

Pakistani traders can access competitive spreads on major pairs involving PKR. The platform allows flexible account settings supporting various trading styles.

Trading Account Configuration Options

Clients select leverage levels up to 1:500 for forex trading and 1:100 for CFDs on commodities. Choose between fixed or floating spreads based on preferred strategies. The platform supports scalping, day trading, and long-term investments. Account base currencies include USD, EUR, and GBP to match Pakistani client preferences.

Platform Access and Download Procedures

Download MT4, MT5, or cTrader platforms directly from FxPro Direct after verification. Installation files support Windows, macOS, iOS, and Android systems. Each platform includes Pakistani customer support contacts. Alternatively, use WebTrader via any modern browser without installation. Mobile apps enable trading on smartphones and tablets throughout Pakistan.

Security Features and Account Protection

Verification activates multiple security layers protecting Pakistani client accounts. Two-factor authentication via SMS codes sent to verified Pakistani mobile numbers provides additional login security. Our system monitors all account activity for suspicious transactions or unauthorized access. Alerts are sent immediately to Pakistani clients for unusual events.

- Two-factor SMS authentication using Pakistani numbers

- Real-time transaction monitoring and fraud detection

- 256-bit SSL encrypted data transmission

- Segregated client funds in European tier-one banks

- Regular security audits and compliance checks

Funds are stored separately from the company’s operational accounts to protect Pakistani client deposits under European investor compensation schemes.

Compliance and Regulatory Framework

FxPro operates under rigorous European regulatory oversight, ensuring Pakistani client protection. Our verification procedures align with Pakistani State Bank rules and international financial standards. We hold licenses from multiple European financial authorities. Pakistani clients benefit from investor protection frameworks and strict KYC protocols.

| Regulatory Aspect | Pakistani Requirements | European Standards | Client Protection |

|---|---|---|---|

| Identity Verification | CNIC validation | KYC compliance | Fraud prevention |

| Fund Protection | SBP guidelines | Segregated accounts | Compensation schemes |

| Data Privacy | Pakistani laws | GDPR compliance | Secure processing |

We report suspicious transactions to Pakistani and European authorities as required. Detailed transaction logs support regulatory audits. Pakistani client data is protected under European privacy laws.

Anti-Money Laundering Compliance

Verification includes enhanced due diligence on high-risk Pakistani transactions. Client names are screened against international sanctions and politically exposed person lists. Large deposits require supporting source of funds documentation. Acceptable proof includes salary certificates, business income statements, or investment portfolios. Our compliance team reviews all financial data carefully.

Data Protection and Privacy Standards

Pakistani client information is encrypted during transmission and storage. Access to personal data is restricted to authorized employees only. Regular staff training ensures compliance with data privacy protocols. Information sharing occurs solely with client consent or legal obligation. Account deletion requests are processed within thirty days.

Customer Support and Assistance Services

Our Pakistan-based support team offers assistance in English and Urdu. Contact options include live chat, email, and telephone during Pakistani business hours. Dedicated support lines address verification-related issues. Representatives provide step-by-step help with document uploads and troubleshooting. Verification problems typically resolve within 24 hours of inquiry.

Clients can access comprehensive verification instructions and video tutorials through the Pakistani client portal. The knowledge base contains updated answers to common questions about verification requirements. This support system ensures a smooth verification experience for Pakistani traders.

❓ FAQ

How to verify FxPro account in Pakistan?

Log in to FxPro Direct, upload your Pakistani CNIC front and back photos, submit proof of address, and complete mobile phone verification. Our team processes the verification within 24-48 hours.

What documents are accepted for address proof?

Utility bills from K-Electric, SNGPL, SSGC, PTCL or bank statements from Pakistani banks issued within three months are acceptable.

How to complete mobile verification?

Enter your Pakistani mobile number with country code +92. Receive an SMS code and input it within 10 minutes to verify your phone.

What causes verification delays?

Poor document quality, expired IDs, or mismatched personal details often cause delays. Resubmitting clear images and updating profile data can resolve these issues.

Can I trade before verification completes?

No. Verification is mandatory before accessing live trading accounts, deposits, or withdrawals on FxPro in Pakistan.