FxPro Age Requirements Pakistan

Learn FxPro minimum age requirements in Pakistan. Complete eligibility criteria, account verification process, and legal trading age limits.

Minimum Age Requirements for FxPro Trading Accounts

Our company enforces a strict minimum age limit of 18 years for all Pakistani traders. This requirement applies uniformly to every account type available on our platform. We verify age using a robust identification process that aligns with both local and international regulations. During account registration, Pakistani residents must submit valid CNIC or equivalent official ID. Our automated systems cross-check birth dates against government records to ensure compliance.

After initial automated screening, our compliance team conducts a manual review to confirm eligibility. This two-step verification typically finalizes within 24 to 48 hours. Traders who do not meet the minimum age cannot proceed with account creation or trade execution. Maintaining regulatory adherence protects your trading environment and our platform integrity.

| Age Category | Account Access | Verification Required | Processing Time |

|---|---|---|---|

| Under 18 | Not Permitted | N/A | N/A |

| 18-65 | Full Access | CNIC + Address Proof | 24-48 hours |

| Over 65 | Full Access | Enhanced Verification | 48-72 hours |

Legal Framework Governing Trading Age in Pakistan

Securities and Exchange Commission Regulations

The Securities and Exchange Commission of Pakistan (SECP) sets the legal minimum age for trading at 18 years. FxPro fully complies with SECP mandates by enforcing age verification on all accounts. Our legal team monitors changes in regulations continuously to maintain conformity. We exceed baseline verification requirements by demanding detailed document validation. This strict approach ensures lawful and secure trading experiences for all Pakistani users.

Banking and Financial Services Compliance

Pakistani banking laws require users to be adults to access financial services. Our age verification integrates with local banking partners and databases where permitted by law. This integration expedites age confirmation for Pakistani traders. Accounts flagged with discrepancies undergo further document review. We ensure consistent compliance with the State Bank of Pakistan’s adult access policies.

Account Types and Age-Related Restrictions

FxPro provides various account types including standard, premium, Islamic, and professional accounts. Each type requires traders to be at least 18 years old. No exceptions are made based on account classification or trading instruments involved. Even demo accounts require full age verification before access is granted. This policy guarantees consistent regulatory compliance across all Pakistani accounts.

Joint Account Considerations

Joint accounts must have all holders meet the 18-year age minimum. Pakistani law stipulates adult status for joint financial responsibility. Each holder’s identity and age are verified independently during registration. Our platform flags discrepancies and initiates manual reviews. This ensures all individuals involved meet legal trading requirements.

Professional Account Requirements

Professional accounts have additional capital and experience criteria but share the same age prerequisites. Traders must meet the 18-year minimum regardless of professional status. Verification includes identity, age, and financial background checks. Compliance with these rules protects both the trader and the platform from regulatory penalties.

Documentation Requirements for Age Verification

Primary Identification Documents

Pakistani traders must submit government-issued IDs for age confirmation. Accepted documents include CNIC cards, passports, driving licenses, official employee cards, and military IDs. Submitted IDs must clearly display birth date and photograph. Our verification system uses advanced algorithms to detect document validity and authenticity. Poor quality scans or photos require resubmission for processing.

Supporting Documentation

When primary documents are unclear, we may request supplementary papers such as birth certificates or educational credentials. These provide additional proof of age and identity. Our compliance team evaluates these documents on individual merit. Only certified and legible documents are accepted to uphold verification integrity.

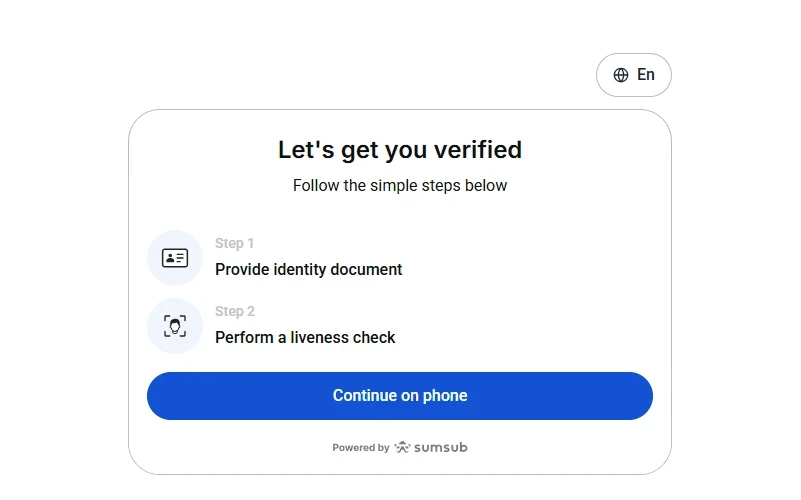

Verification Process Timeline and Procedures

Verification starts immediately upon account creation and document submission. Automated checks analyze submitted IDs within minutes. Cases requiring manual intervention or additional documents extend processing times. Most Pakistani accounts finalize verification within 24 to 48 hours. Complex verifications may take up to 96 hours. Traders receive regular status notifications throughout.

| Verification Stage | Automated Processing | Manual Review | Total Timeline |

|---|---|---|---|

| Initial Screening | 5-10 minutes | N/A | 5-10 minutes |

| Document Analysis | 2-4 hours | 12-24 hours | 14-28 hours |

| Final Approval | Instant | 4-8 hours | 4-8 hours |

Common Verification Delays

Verification delays frequently result from poor document quality or mismatched names. Pakistani traders must ensure exact name consistency across all documents. Address mismatches or outdated details also prolong processing. We provide detailed feedback to resolve issues quickly. Prompt resubmission minimizes verification downtime.

Consequences of Age Requirement Violations

Account Suspension Procedures

If underage status is detected, the account is immediately suspended. All trading and deposit functions become inactive pending compliance resolution. Suspended accounts allow withdrawals only, ensuring no unauthorized trading occurs. Our monitoring systems trigger suspension automatically when violations arise. Traders must re-verify or close accounts to regain access.

Legal and Regulatory Implications

Violations of age requirements involve penalties under Pakistani law. Regulatory bodies may sanction both traders and platforms for breaches. FxPro reports detected violations to appropriate authorities promptly. We maintain transparent records of all enforcement actions. Fraudulent document use or multiple account attempts also prompt reporting.

Parental Consent and Guardian Involvement

Legal Restrictions on Minor Trading

Pakistani law forbids parental or guardian consent to override age limits. FxPro cannot accept substitute authorizations for minors. Account holders must personally meet the 18-year threshold. Parents cannot open accounts on behalf of underage children, regardless of circumstances. This policy preserves legal and financial responsibility integrity.

Educational Account Alternatives

We provide educational tools aimed at younger audiences interested in trading concepts. Virtual simulators allow simulated trading without real financial risk. Pakistani students aged 16 and above can access these learning platforms under restricted conditions. Educational webinars and articles foster understanding of market dynamics. These resources prepare future traders for legal account access.

| Educational Resource | Age Restriction | Access Method | Cost |

|---|---|---|---|

| Market Analysis Articles | None | Website/App | Free |

| Trading Webinars | None | Registration Required | Free |

| Virtual Simulator | 16+ (Educational Only) | Limited Access | Free |

| Strategy Guides | None | Download Available | Free |

Account Monitoring and Ongoing Age Compliance

Our compliance framework continuously monitors Pakistani accounts for age-related irregularities. Automated alerts identify suspicious activity patterns indicating underage trading. Prompt investigations follow all flagged cases to ensure compliance. Regular audits assess verification protocol effectiveness. We update procedures based on audit outcomes and regulatory changes.

Technology and Security Measures

Biometric verification, including facial recognition, strengthens age confirmation efforts. This technology compares ID photos to submitted selfies, reducing identity fraud risk. Our system detects multiple account creation attempts from the same user or device. IP blocking and machine learning algorithms further enhance security. These technologies guarantee a compliant and secure trading environment for Pakistani users.

❓ FAQ

How old do you have to be to use FxPro in Pakistan?

The minimum age to open and use an FxPro trading account in Pakistan is 18 years. Verification requires valid government-issued ID confirming age.

What documents are needed for age verification?

Pakistani residents must submit CNIC, passport, or driving license showing birth date. Additional documents may be requested if verification requires further proof.

Can minors trade with parental consent?

No. Pakistani law prohibits trading under 18 years old, even with parental or guardian consent. FxPro enforces this strictly.

How long does the age verification process take?

Most age verifications complete within 24-48 hours, depending on document quality and manual review requirements.

What happens if an account is found underage?

Such accounts are suspended immediately. Trading is disabled, but withdrawals remain available. Regulatory authorities are notified as required.