How Many FxPro Accounts Can You Have

Open multiple FxPro trading accounts in Pakistan. Access different account types, manage diverse strategies, and maximize your forex trading potential.

FxPro Multiple Account Policy for Pakistani Traders

Our company permits Pakistani traders to hold multiple trading accounts under defined conditions. We provide the ability to open separate accounts to accommodate different trading strategies and risk controls. Verified clients in Pakistan can maintain up to five live accounts at once, each with unique login credentials. Verification of identity through CNIC is mandatory before new accounts are approved. This ensures secure and compliant access to our platform services.

| Account Type | Minimum Deposit (USD) | Maximum Leverage | Spread Type |

|---|---|---|---|

| Standard | 100 | 1:500 | Fixed |

| Raw Spread | 200 | 1:500 | Variable |

| Zero | 500 | 1:200 | Commission-based |

All accounts operate independently with separate margin and equity calculations. Traders often open multiple accounts to segregate scalping from longer-term trades. The application process for additional accounts is streamlined for existing clients, reducing verification time. This flexibility supports diverse trading needs while maintaining regulatory standards.

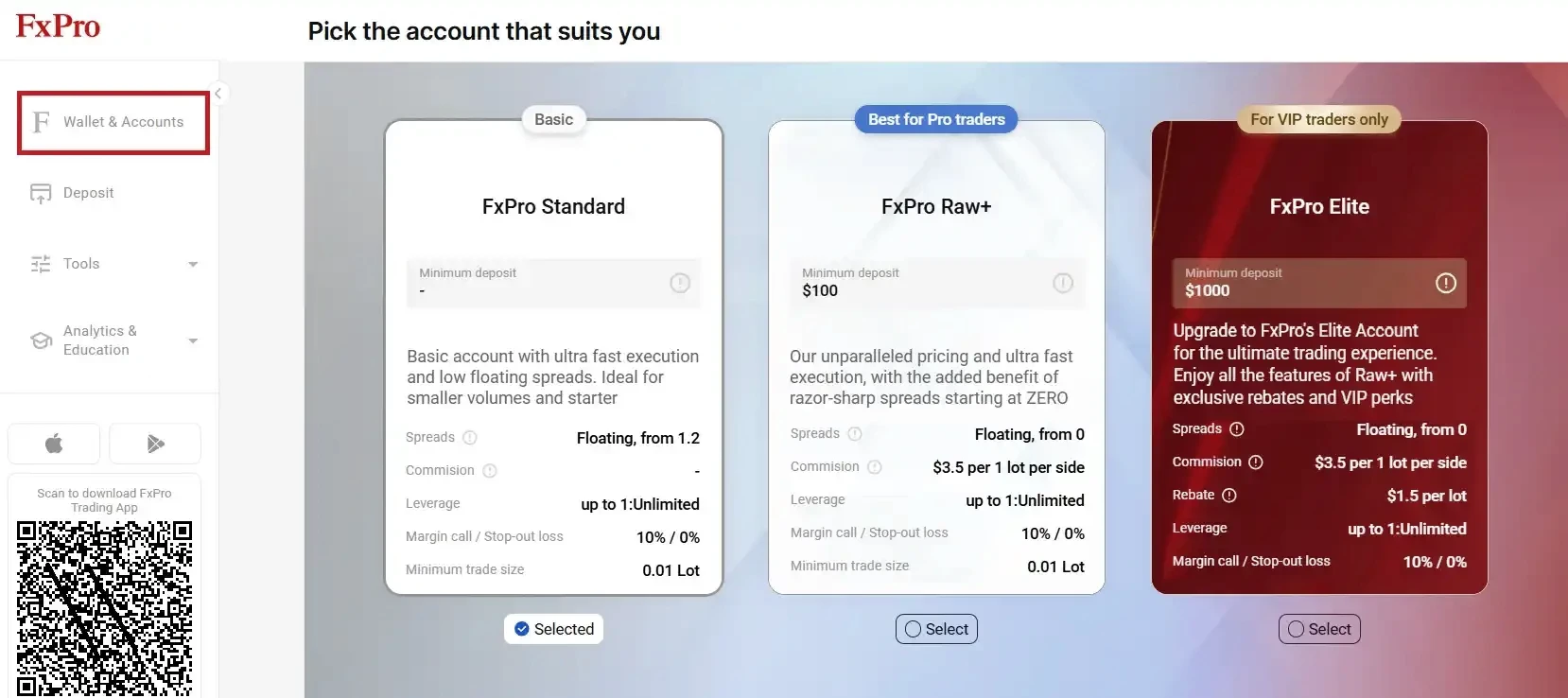

Account Types Available for Pakistani Clients

We offer three main account types tailored to different trading preferences and capital requirements. Standard accounts feature fixed spreads and no commissions, ideal for beginner traders. Raw Spread accounts provide variable spreads from 0.0 pips with commissions applied per lot. Zero accounts eliminate spreads on major pairs but charge higher commissions, suited for high-frequency traders.

Each account type grants access to the full range of forex pairs and CFDs supported in Pakistan. Leverage options vary between 1:200 and 1:500 depending on account and instrument. We process PKR deposits through local banking and digital payment channels. Our pricing models cater to various trading styles and volumes.

Standard Account Features

The Standard account requires a minimum deposit of 100 USD (or equivalent in PKR). Traders gain access to over 70 currency pairs with fixed spreads ranging from 1.8 to 3.5 pips. Leverage is available up to 1:500 for forex and 1:100 for CFDs. Overnight swap rates are applied based on interbank lending standards. Execution is market-based with no requotes under normal conditions.

Raw Spread Account Advantages

Raw Spread accounts offer spreads starting at zero pips with a commission of 3.5 USD per standard lot. This account connects directly to liquidity providers for faster execution. It supports automated trading tools, including Expert Advisors, with no restrictions. The minimum deposit is 200 USD, with leverage options matching Standard accounts. This account suits traders looking for cost-efficient high-frequency trading.

Zero Account Specifications

Zero accounts remove spreads on major pairs like EUR/USD and GBP/USD, charging commissions between 4.5 and 9 USD per lot. The minimum deposit is 500 USD, with leverage capped at 1:200. Institutional clients in Pakistan often use Zero accounts for portfolio management due to transparent pricing. Priority customer support is provided exclusively for Zero account holders.

Multiple Account Management System

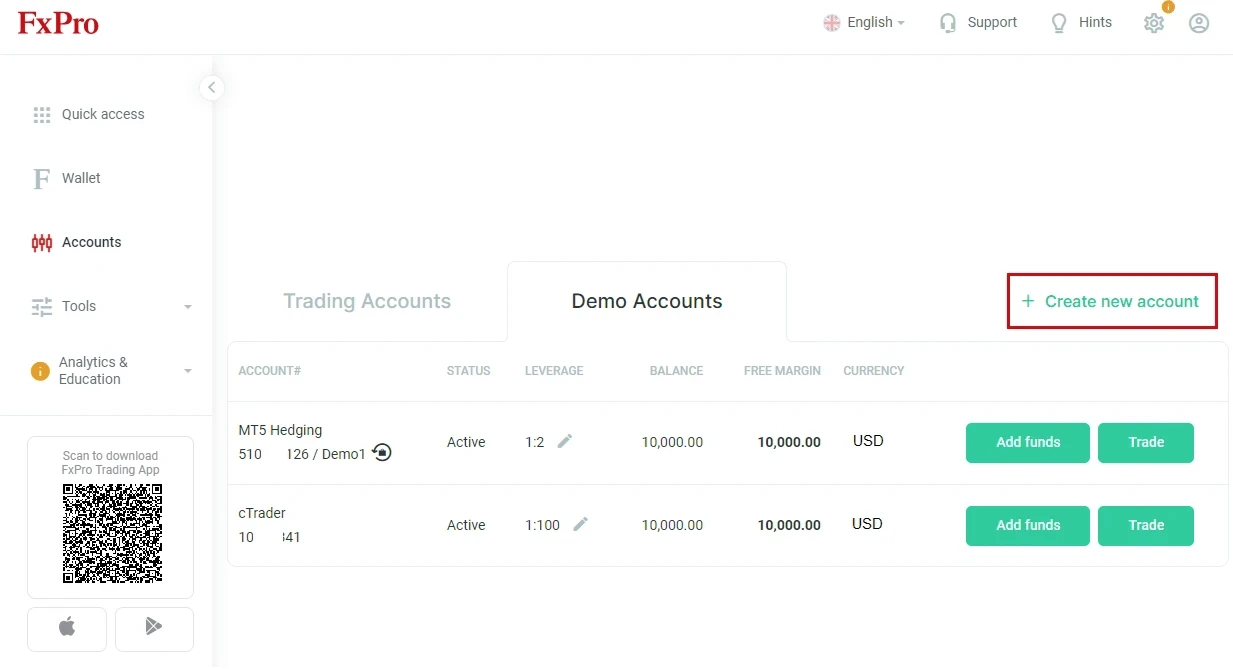

Our proprietary management system enables Pakistani traders to oversee all their FxPro accounts from a single interface. The dashboard consolidates equity, margin usage, and profit/loss across accounts. Account-to-account transfers are possible within 24 hours for verified clients. Each account retains independent trading history and risk parameters.

Simultaneous logins on multiple MetaTrader 4 or 5 platforms are supported. Margin calls on one account do not impact others due to strict fund segregation. This separation helps traders manage risk more effectively across various strategies. Monthly statements are generated individually to assist Pakistani traders with tax reporting.

Strategic Benefits of Multiple Trading Accounts

By maintaining multiple FxPro accounts, Pakistani traders can implement distinct trading approaches concurrently. This allows segregation of automated systems from manual trades and allocation of specific accounts for certain currency pairs or instruments. Diversification across asset classes reduces portfolio risk. Account-level risk controls enable precise stop-loss and position size settings.

These strategic advantages include:

- Separating automated from discretionary trading

- Focusing accounts on particular currency pairs or commodities

- Setting individual risk and position limits per account

- Allocating accounts to different market sessions or timeframes

- Monitoring overall exposure and preventing over-leverage

| Strategy Type | Recommended Account | Risk Level | Typical Timeframe |

|---|---|---|---|

| Scalping | Raw Spread | High | 1-15 minutes |

| Day Trading | Standard | Medium | 15 minutes – 4 hours |

| Swing Trading | Zero | Low-Medium | 1-7 days |

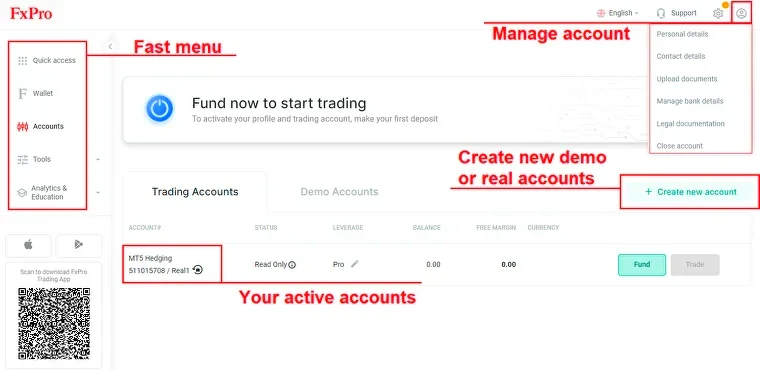

Account Opening Process for Additional Accounts

Pakistani clients with existing FxPro accounts can apply for additional accounts via the client portal. The process requires completing an application specifying the desired account type and trading strategy. Verification documents already submitted remain valid, expediting approval. Most applications are processed within 24 hours for verified traders.

Documentation Requirements

We require proof of identity and address for all accounts. CNIC is mandatory, and address verification must be current within three months. Acceptable documents include utility bills or bank statements. For deposits exceeding 10,000 USD, source of funds declaration is necessary to comply with Pakistani AML regulations. This ensures adherence to both local and international standards.

Application Submission Steps

Log into the FxPro client portal using your registered credentials. Navigate to “Account Management” and select “Open Additional Account.” Complete all required fields, including account type and strategy description. Submit the form and wait for email confirmation. Upon approval, funding instructions and login details are sent promptly.

Funding and Withdrawal Procedures

Each FxPro account maintains its own funding and withdrawal processes. Pakistani traders can deposit via local bank transfers in PKR, international SWIFT transfers, credit cards, and digital wallets such as Skrill and Neteller. Internal transfers between accounts under the same client ID complete within 24 hours without fees for up to five monthly transfers.

Withdrawals require separate requests per account and follow stringent verification protocols. Withdrawals above 100,000 PKR may require additional documentation in line with Pakistani banking regulations. We aim to process withdrawal requests within two business days, ensuring prompt access to funds.

Available funding methods for Pakistani clients include:

- Local bank wire transfer in PKR

- International SWIFT transfers in USD or EUR

- Visa and Mastercard payments

- Skrill and Neteller e-wallets

- Perfect Money and other approved digital payment systems

Trading Platform Access and Management

FxPro offers MetaTrader 4 and MetaTrader 5 platforms for each account. Pakistani traders can run multiple installations simultaneously to monitor various accounts. Each installation requires unique login details and server information. We recommend installing each platform in separate directories to avoid login conflicts.

Platform Installation Guidelines

Download the latest MetaTrader versions from the FxPro website. During installation, specify distinct folders for each account platform. Use clear desktop shortcuts labeled with account numbers for easy access. Verify server connectivity and account balance before trading. Technical support is available to assist with setup issues common in Pakistan.

Mobile Trading Applications

The FxPro mobile app supports multiple account logins within a single interface. Switch accounts quickly using the built-in selector. Real-time synchronization ensures trades and balances update across desktop and mobile devices. Push notifications keep traders informed about margins, orders, and market changes. The mobile app supports nearly all desktop trading features except some advanced custom indicators.

| Platform Feature | Desktop MT4/MT5 | Mobile App | Web Platform |

|---|---|---|---|

| Multiple Account Access | Yes | Yes | Yes |

| Expert Advisors | Yes | Limited | No |

| Custom Indicators | Yes | No | Limited |

| One-Click Trading | Yes | Yes | Yes |

Regulatory Compliance and Account Limitations

FxPro adheres to international financial regulations and local Pakistani foreign exchange laws regarding multiple account holdings. Pakistani traders must comply with State Bank of Pakistan requirements for foreign currency trading. We monitor account activities to prevent regulatory violations and comply with AML and KYC standards.

Account approval for additional accounts depends on verification level and trading history. We may restrict new account openings for clients with compliance or trading issues. Regulatory updates in Pakistan could alter policies on multiple accounts, requiring clients to consolidate accounts if necessary.

Our compliance team ensures that all accounts meet legal obligations. Pakistani traders must report significant profits to tax authorities as required. Understanding how many FxPro accounts can you have allows Pakistani traders to optimize risk management and trading efficiency while staying compliant.

❓ FAQ

How many FxPro accounts can you have in Pakistan?

Pakistani traders can open up to five verified live trading accounts simultaneously with FxPro, subject to verification and regulatory compliance.

Can I transfer funds between multiple FxPro accounts?

Yes, internal transfers between your FxPro accounts complete within 24 hours with no fees for up to five transfers monthly.

What documents are needed to open multiple accounts?

Valid CNIC for identity verification and a recent proof of address such as a utility bill or bank statement are required for all accounts.

Are the account types available the same for all accounts?

Yes, Pakistani traders can open Standard, Raw Spread, or Zero accounts independently under each trading account.

Can I manage all FxPro accounts from one platform?

Yes, you can manage multiple accounts through separate MetaTrader installations or use the FxPro mobile app to switch between accounts easily.