FxPro Withdrawal Processing Times

Process FxPro withdrawals in Pakistan efficiently. Our platform offers multiple payment methods with transparent timeframes for Pakistani traders.

Understanding FxPro Withdrawal Systems in Pakistan

Our company offers Pakistani traders a secure and efficient withdrawal system. Multiple verification steps guarantee fund safety while ensuring competitive timeframes. We support various payment methods tailored to Pakistan’s banking environment. Withdrawal requests undergo automated validation to confirm account details and compliance. Dedicated teams handle Pakistani accounts to meet local banking and regulatory standards.

Withdrawal processing times depend on chosen methods and verification status. Verified accounts benefit from faster transactions. We advise completing verification promptly to avoid delays. Our system factors in Pakistan’s banking holidays to give accurate estimates. Withdrawals can be made via local banks, international wires, cards, or e-wallets.

| Withdrawal Method | Minimum Amount | Maximum Amount | Processing Time |

|---|---|---|---|

| Bank Transfer | $50 | $50,000 | 1-3 business days |

| Credit Card | $10 | $10,000 | 2-5 business days |

| E-wallets | $5 | $25,000 | 24-48 hours |

Step-by-Step Withdrawal Process for Pakistani Traders

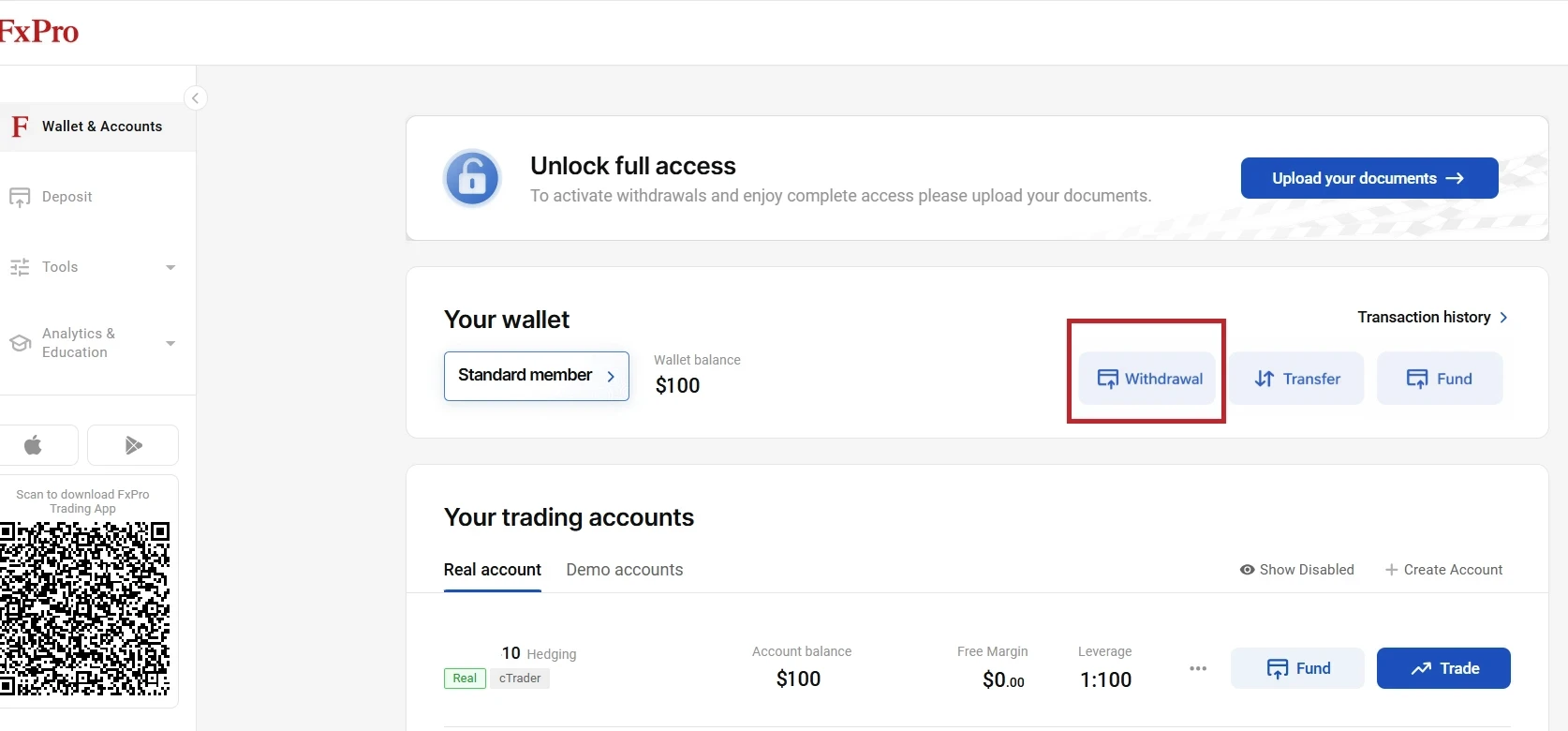

Accessing Your Trading Account Dashboard

Log in to the FxPro client portal using your credentials. The dashboard shows your balance, withdrawable funds, and transaction history. Locate the “Withdraw Funds” option in the account management menu. Withdrawal amounts reflect real-time available balance after margin requirements. This prevents requests exceeding your eligible funds.

Selecting Withdrawal Methods

Choose from withdrawal options available for Pakistani traders. Each method lists estimated processing times, fees, and limits. Supported banks include HBL, UBL, MCB, and Allied Bank. Enter withdrawal amount in your base currency; conversions to PKR occur automatically for local bank transfers. Exchange rates refresh frequently to ensure accuracy.

Completing Verification Requirements

If your account is not fully verified, upload documents such as CNIC, bank statements, and proof of address. Accepted proofs include utility bills or government letters. After submitting the withdrawal request, you will receive a confirmation email with reference numbers and expected processing dates. SMS updates are sent to registered Pakistani mobile numbers.

Payment Methods Available for Pakistani Withdrawals

We provide withdrawal channels adapted to Pakistani financial infrastructure. Local bank transfers are the quickest, typically completing within 1-2 business days. International wire transfers support USD and EUR withdrawals with longer processing times. Card withdrawals return funds to the funding source, supporting Visa and Mastercard issued in Pakistan.

E-wallets such as Skrill, Neteller, and Perfect Money offer fast processing, often within 24-48 hours. Minimum withdrawal amounts are lower for e-wallets compared to traditional methods. Our payment team maintains strong ties with Pakistani banks to ensure smooth transactions and updates services according to regulatory changes.

Supported E-wallet Providers

- Skrill: 24-hour processing, $5 minimum

- Neteller: 48-hour processing, $10 minimum

- Perfect Money: Instant processing, $5 minimum

- WebMoney: 24-hour processing, $20 minimum

- PayPal: 2-3 business days, $25 minimum

Processing Timeframes and Factors Affecting Speed

Standard Processing Windows

Withdrawals are processed during Pakistani business days, excluding weekends and national holidays. Requests after 6 PM PST are queued for the next business day. Fully verified accounts undergo automated processing, usually within 1-3 days. Partially verified or unverified accounts experience manual review, increasing processing times.

Factors That May Cause Delays

Large withdrawals above $10,000 require additional security and compliance checks. We assess account activity and source of funds documentation for these transactions. Delays may also arise from banking network issues or incomplete documentation. Maintaining updated CNIC and address proofs helps prevent delays.

| Verification Level | Standard Amount | Large Amount | Processing Time |

|---|---|---|---|

| Fully Verified | Up to $5,000 | $5,001-$25,000 | 1-3 business days |

| Partially Verified | Up to $1,000 | $1,001-$5,000 | 2-4 business days |

| Unverified | Up to $500 | Above $500 | 3-7 business days |

Fees and Charges for Pakistani Withdrawals

Withdrawal fees vary depending on the payment method and amount. Bank transfers above $100 to Pakistani banks are free. Smaller transfers incur a $15 fee. Credit/debit card withdrawals carry a 2.5% fee with a minimum of $5. E-wallet fees range from 1-2%, with some providers offering fee-free options above certain amounts.

Currency conversion fees apply when withdrawing in currencies different from your account base currency. We apply interbank rates plus a 0.5% margin. All fees are clearly displayed before finalizing withdrawal requests, ensuring transparency for Pakistani traders.

Minimizing Withdrawal Costs

Combining smaller withdrawals into larger ones helps reduce fees. Local Pakistani bank transfers are usually the most cost-effective method. Planning withdrawals according to trading cycles and fee thresholds optimizes expenses. We encourage evaluating withdrawal patterns regularly to identify savings opportunities.

| Payment Method | Fee Structure |

|---|---|

| Pakistani Bank Transfers | Free over $100, $15 below $100 |

| International Wire Transfers | $25 flat fee |

| Credit/Debit Cards | 2.5% (min $5) |

| Skrill/Neteller | 1.5% (min $2) |

| Perfect Money | Free above $50, $1 below $50 |

Security Measures and Verification Requirements

We apply multi-factor security protocols to all withdrawal requests from Pakistan. IP addresses, device fingerprints, and login behavior are analyzed during processing. Withdrawals over $1,000 require two-factor authentication via SMS codes or authenticator apps. These measures protect funds and verify trader identity.

Verification documents include CNIC, bank statements, and proof of address. Accepted proofs must be recent and clear. Our compliance team reviews documents within 24-48 hours for Pakistani clients, using encrypted upload systems to safeguard data.

Enhanced Security for Large Withdrawals

Withdrawals exceeding $25,000 undergo stringent compliance checks. Traders must submit source of funds documentation and may be contacted for phone verification. These steps align with regulatory requirements and ensure legitimate fund transfers.

| Document Type | Acceptance Criteria | Verification Time | Validity Period |

|---|---|---|---|

| CNIC | Clear, unedited copy | 2-4 hours | 5 years |

| Bank Statement | Recent, showing name and address | 4-8 hours | 3 months |

| Address Proof | Government or utility issued | 2-6 hours | 3 months |

Troubleshooting Common Withdrawal Issues

Resolving Processing Delays

If your withdrawal exceeds expected timeframes, contact our Pakistani support team promptly. We offer local phone support and assistance in Urdu. Tracking your withdrawal status is possible via email and SMS alerts. Verify that bank details perfectly match your registered account to avoid delays.

Addressing Rejected Withdrawals

Review rejection reasons provided via your client portal or email. Typical causes include expired CNIC, mismatched bank data, insufficient funds, or incomplete verification. Resubmit updated documents through the secure portal for faster review. Our support team is available to help resolve complex cases.

- Expired CNIC: Upload current copy

- Bank detail mismatch: Correct account information

- Insufficient funds: Verify balance before requesting

- Incomplete verification: Provide required documents

- Technical errors: Contact support for assistance

Optimizing Your Withdrawal Strategy

Schedule withdrawals around Pakistani banking hours and holidays to avoid delays. Early week requests typically process faster than those near weekends. Keep verification documents current to access faster processing and higher limits. Analyze withdrawal frequency and amounts to reduce total fees.

Choose withdrawal methods based on urgency and cost. E-wallets provide quick transfers for smaller amounts, while bank transfers are preferable for larger sums. Monitor exchange rates with our platform’s real-time display to maximize conversion value. Use withdrawal history tools to refine your strategy periodically.

| Withdrawal Method | Typical Use Case | Processing Time | Cost Efficiency |

|---|---|---|---|

| Local Bank Transfer | Larger amounts in PKR | 1-2 business days | High |

| E-wallets | Small, urgent withdrawals | 24-48 hours | Moderate |

| Credit/Debit Cards | Refund to funding source | 2-5 business days | Lower |

| International Wire | Foreign currency withdrawals | 3-5 business days | Variable |

❓ FAQ

What is the typical FxPro Withdrawal Time in Pakistan?

Withdrawal times vary by method; local bank transfers usually take 1-2 business days, while e-wallets process within 24-48 hours.

How can I speed up my withdrawal process?

Complete full account verification promptly and submit withdrawal requests during Pakistani business hours to minimize delays.

Are there any fees for withdrawing funds in Pakistan?

Fees depend on withdrawal method and amount; local bank transfers over $100 are free, while cards and e-wallets may incur small fees.

What documents are required for withdrawal verification?

Pakistani traders must provide CNIC, proof of address (utility bill or government letter), and bank statements showing account ownership.

What should I do if my withdrawal is rejected?

Check the rejection reason in your client portal, update any missing or incorrect documents, and contact support for personalized assistance.