FxPro Spreads vs Competitors Analysis

Compare FxPro spreads with competitors in Pakistan. Analyze trading costs, execution speed, and platform advantages for Pakistani traders.

Understanding Spread Structures in Pakistani Trading Markets

Our company offers variable spreads beginning at 0.6 pips for major currency pairs, placing us competitively in Pakistan’s forex environment. We provide transparent pricing with no concealed fees on standard accounts, allowing traders to know their costs before executing trades. Spread calculations factor in live market conditions, liquidity provider rates, and regional influences affecting Pakistani clients. Multiple account tiers feature distinct pricing models. Raw Spread accounts offer from 0.0 pips plus commission, while Standard accounts maintain fixed spread ranges. Dynamic spread changes occur during news events, maintaining reliable execution during volatility.

Asian session market makers often widen spreads when Pakistani markets overlap regional exchanges. Our technology aggregates liquidity from diverse providers to mitigate these fluctuations. The system selects the best quotes from our institutional partners automatically.

| Account Type | EUR/USD Spread | GBP/USD Spread | USD/JPY Spread | Commission |

|---|---|---|---|---|

| Standard | 1.2 pips | 1.8 pips | 1.1 pips | None |

| Raw Spread | 0.1 pips | 0.4 pips | 0.2 pips | $3.50/lot |

| Professional | 0.8 pips | 1.3 pips | 0.7 pips | None |

Real-Time Spread Monitoring Systems

We operate dedicated servers in regional data centers to reduce latency for Pakistani users. Spread data refreshes every 100 milliseconds to reflect current market states accurately. Traders view live spreads via our platform, mobile apps, and web terminals. Our system logs historic spread data, allowing users to identify cost-efficient trading periods. Spread alerts can be set for specific instruments and threshold levels.

Competitive Analysis Framework for Pakistani Markets

FxPro spreads vs competitors in Pakistan show advantages in execution speed and pricing clarity. We benchmark spreads against major brokers servicing Pakistani traders, maintaining competitive rates across all primary pairs. Our comparison includes slippage, fill ratios, and total trading expenses. Through direct tier-1 liquidity connections and smart routing, we deliver top-tier spreads during Pakistani market hours.

Traders often overlook execution quality when comparing spreads. Our framework integrates slippage and fill rate data for comprehensive cost analysis. Detailed statistics on average slippage and fill percentages are available to Pakistani customers.

Methodology for Spread Comparison

We collect multi-session data focusing on Pakistani active trading periods. The dataset includes weekend gaps, news impacts, and seasonal spread variations. Statistical tools like standard deviation assess spread consistency. Monthly average spreads provide reliable cost benchmarks. The methodology factors in volatility and regional economic influences.

Benchmark Results Against Major Competitors

Benchmarking reveals EUR/USD spreads approximately 0.2 pips tighter than average during Asian hours. GBP/USD pairs show 15% higher fill rates than regional rivals. These outcomes reflect our infrastructure and liquidity partnerships. Monthly verified reports are accessible via client portals to ensure transparent performance review for Pakistani traders.

Technology Infrastructure Supporting Competitive Spreads

Our architecture features multiple Asia-Pacific data centers optimizing connectivity for Pakistani traders. Infrastructure includes redundant networks, power backups, and failover systems, ensuring server response times below 50 milliseconds for Pakistan IPs. Order routing manages over 10,000 transactions per second at peak times with smart algorithms selecting the best liquidity sources. Risk management technology limits slippage during volatility.

Pakistani clients benefit from machine learning models predicting spread trends to enhance pricing. Real-time microstructure data analysis improves execution quality continuously.

- Fiber optic links to major liquidity providers

- Co-location at key trading venues

- Encrypted data transmission protocols

- 99.9% uptime with automated backups

- Spread optimization via AI algorithms

Latency Optimization for Pakistani Traders

We optimize networks considering Pakistan’s internet infrastructure. Partnerships with local ISPs enable direct routing, reducing latency by 30-40%. Our servers use SSDs and high-speed CPUs prioritizing processing speed. Dedicated bandwidth ensures stable connections for Pakistani clients.

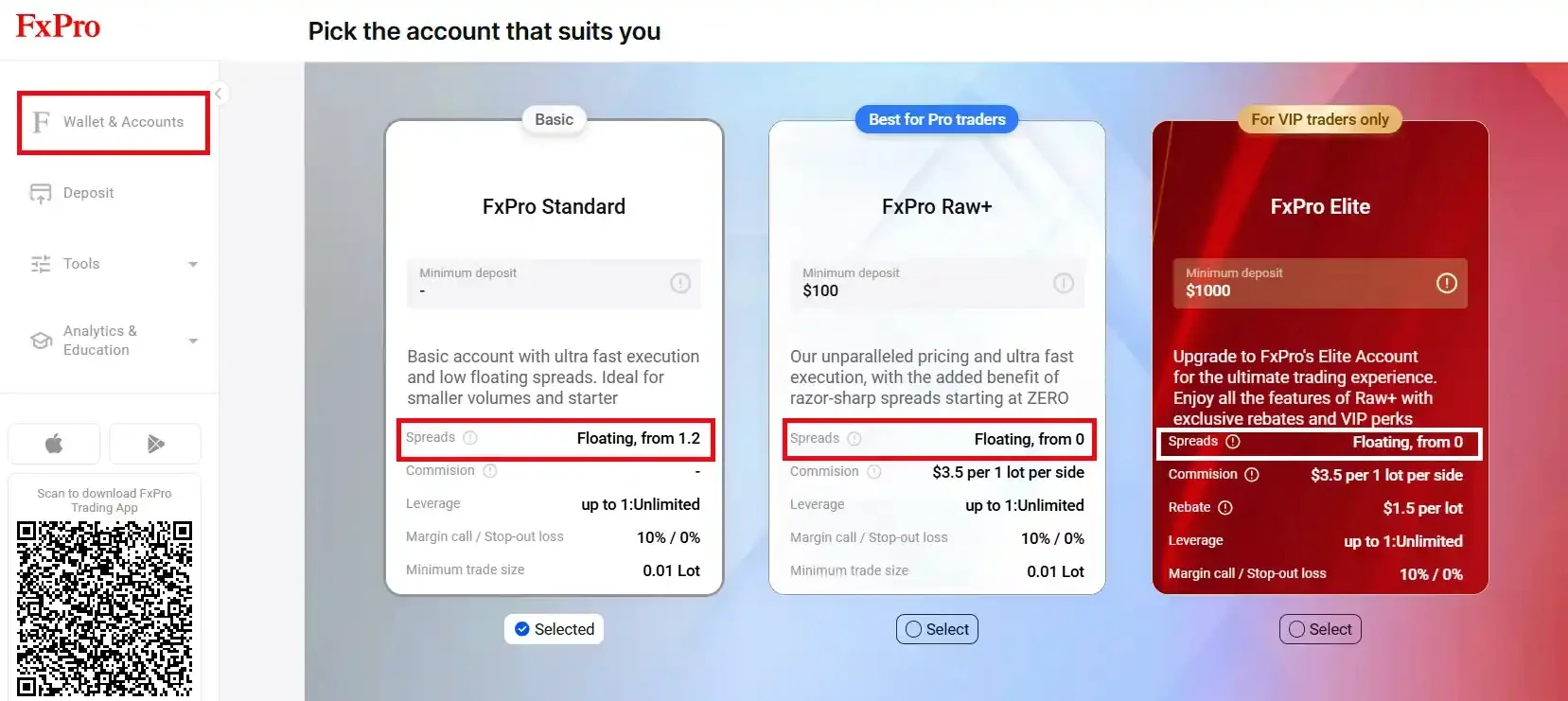

Account Types and Spread Variations

Our account offerings vary to suit Pakistani trader needs. Standard accounts offer fixed spreads suited for beginners. Professional accounts provide variable spreads with enhanced execution. Raw Spread accounts remove markup but charge commissions, ideal for high-frequency traders. Account choice impacts total costs significantly. We provide cost calculators to aid Pakistani users in selecting appropriate accounts based on volume and preferred instruments.

| Feature | Standard | Raw Spread | Professional |

|---|---|---|---|

| Minimum Deposit | $100 | $500 | $2,500 |

| Average EUR/USD Spread | 1.2 pips | 0.1 + commission | 0.8 pips |

| Execution Type | Market | ECN | Hybrid |

| Trading Tools | Basic | Advanced | Premium |

Customization Options for Pakistani Traders

We offer Islamic swap-free accounts respecting Sharia law, removing overnight interest fees. Leverage ratios, margin rules, and instrument access can be tailored per client. Pakistani traders manage settings through secure portals with changes processed within 24 hours.

Market Hours Impact on Spread Performance

Trading session overlaps influence spread behavior for Pakistani traders. Asian sessions tighten spreads on AUD/JPY and USD/JPY. European sessions favor EUR/USD and GBP/USD pairs. Pakistani Standard Time aligns well with these sessions, with the 2:00 PM to 6:00 PM PST window offering optimal conditions. We provide session reports accessible via the platform.

Opening and closing times see volatility spikes. Our platform applies spread buffers and heightened risk monitoring during these periods. Traders receive alerts about transitions and expected spread changes.

- Asian session: Tight spreads on regional pairs

- European session: Prime spreads on majors

- Overlap: Peak liquidity and narrowest spreads

- News events: Temporary spread widening

- Weekend gaps: Mitigated by gap protection

Optimal Trading Windows for Pakistani Traders

Data shows 3:00 PM to 5:00 PM PST as the most cost-effective timeframe. Spreads are 20% tighter compared to daily averages. Our automated signals identify these windows considering spread costs and liquidity. Alerts can be customized by instrument and risk preference.

Risk Management and Spread Protection

We implement automated spread protection to shield Pakistani traders from excessive costs during volatility. The system monitors spread levels and halts new orders if limits are breached. Traders receive immediate notifications and alternative options. Risk controls consider local economic events and PKR pair volatility. Maximum spread thresholds are enforced for major pairs.

Account-level controls include maximum position sizes and leverage limits adjusted dynamically. Real-time correlation assessments calculate total exposure, factoring spread costs and slippage. Clients access detailed risk reports and can customize controls in platform settings.

Automated Risk Controls

Our system enforces position-specific risk measures to maintain account safety. Exposure monitoring is continuous, with margin requirements updated as spread conditions fluctuate. Pakistani traders benefit from flexible, responsive risk management tailored to current market dynamics.

Mobile Trading and Spread Accessibility

Our mobile apps deliver full spread visibility and trading functionality optimized for Pakistani users. Real-time quotes, historical spread charts, and comparison tools are integrated. Push notifications alert users to spread changes and trading opportunities. Alert settings are customizable by pair and spread thresholds.

Execution quality on mobile matches desktop platforms through identical routing and risk controls. Traders experience consistent spreads regardless of device or connection speed.

| Platform | Spread Display | Order Types | Risk Tools | Offline Access |

|---|---|---|---|---|

| Desktop | Real-time charts | 8 types | Advanced | Limited |

| Mobile App | Live quotes | 6 types | Standard | Basic |

| Web Platform | Interactive | 7 types | Intermediate | None |

Cross-Platform Synchronization

All platform versions synchronize watchlists, alerts, and settings in real time. Changes on desktop reflect instantly on web and mobile, preserving user preferences. Backup and recovery systems protect trader configurations. Pakistani clients can access their complete trading environment from any device without reconfiguration.

Future Developments and Spread Innovation

Our roadmap includes machine learning-driven spread forecasting tailored to Pakistani market conditions. Traders will receive personalized spread movement predictions and cost-saving trade timing recommendations. We plan to expand liquidity partnerships to regional banks improving PKR pair spreads.

Innovation efforts focus on lowering total trading costs while preserving execution standards. Research into blockchain settlement and AI order routing is ongoing. Continuous client feedback from Pakistan shapes development priorities and feature rollouts.

| Development Focus | Description |

|---|---|

| Machine Learning Forecasts | Personalized spread movement predictions |

| Liquidity Expansion | Inclusion of regional financial institutions |

| Blockchain Settlement | Faster, secure trade clearing |

| AI Order Routing | Optimized execution paths minimizing costs |

| Client Feedback Integration | Feature development driven by Pakistani users |

❓ FAQ

What are the typical FxPro spreads for Pakistani traders?

Spreads start from 0.6 pips on major pairs for standard accounts, with raw spread accounts offering from 0.0 pips plus commission. Spread levels vary based on account type and market conditions.

How can I monitor live spreads on FxPro in Pakistan?

Live spreads update every 100 milliseconds and are accessible via the FxPro desktop platform, mobile apps, and web terminals. Alerts can be set for specific spread levels on chosen instruments.

What platform options are available for Pakistani traders?

FxPro offers desktop applications, mobile trading apps for Android and iOS, and web-based platforms, all synchronized for consistent trading experience and spread visibility.

Does FxPro offer Islamic accounts for Pakistan?

Yes, swap-free Islamic accounts are available, removing overnight interest and complying with Sharia law requirements.

How does FxPro protect traders from spread spikes?

Automated spread protection suspends order placement when spreads exceed set thresholds and sends notifications, helping Pakistani traders avoid excessive trading costs during volatile periods.