FxPro Account Types Pakistan

Select from multiple FxPro account types in Pakistan. Compare features, spreads, and platforms to find your ideal trading solution.

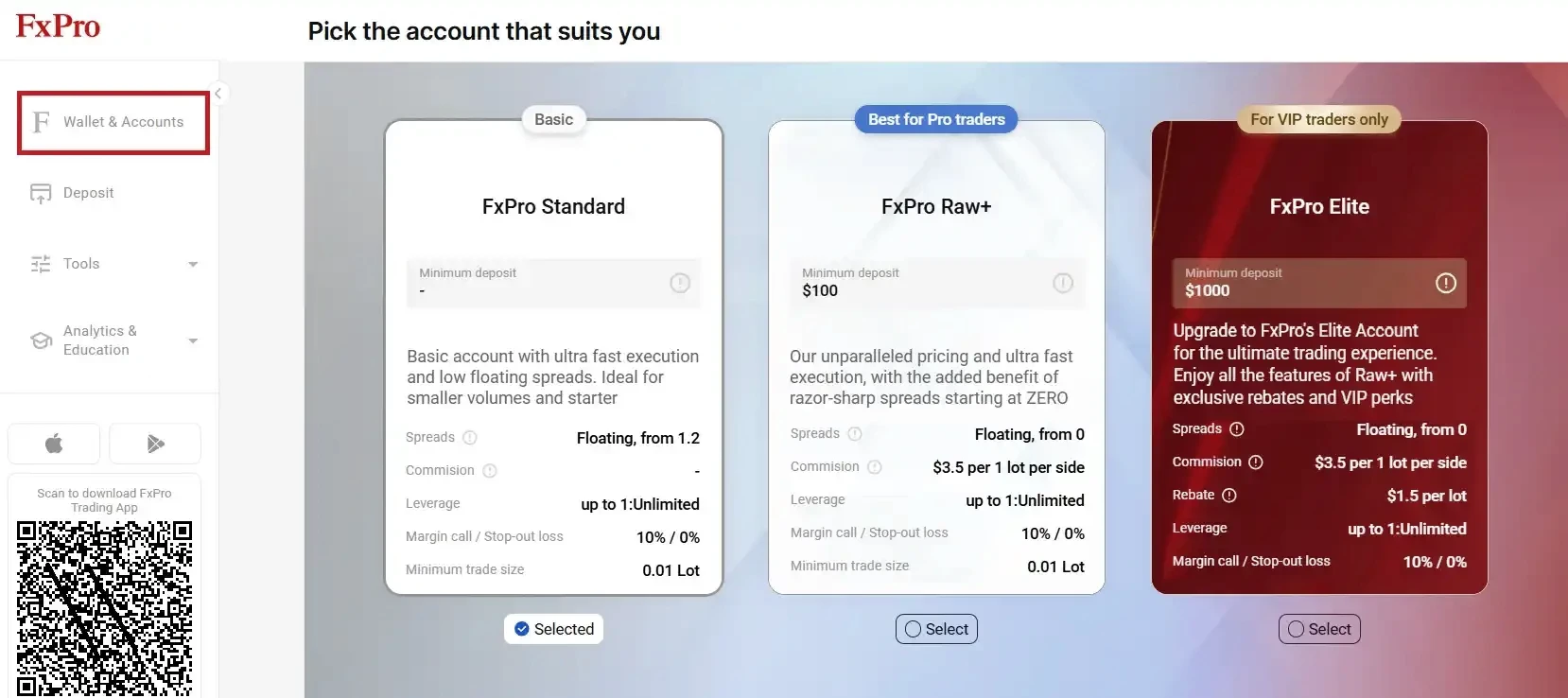

Account Selection Overview

Our company offers a variety of account types tailored specifically for traders in Pakistan. These accounts cater to different trading styles, ranging from beginners to seasoned professionals. Each option features distinct spreads, commission structures, and platform compatibility. Pakistani traders must verify their identity with CNIC and address documents to activate their accounts. The verification process is streamlined, typically completed within one business day.

| Account Type | Minimum Deposit (USD) | Spread Type | Commission | Platform Access |

|---|---|---|---|---|

| MT4 Instant | 100 | Variable | No | MetaTrader 4 |

| MT4 Market | 500 | Variable | Yes | MetaTrader 4 |

| MT5 Instant | 100 | Variable | No | MetaTrader 5 |

| cTrader | 500 | Variable | Yes | cTrader |

When choosing the right FxPro Account Types in Pakistan, consider your preferred instruments and trading strategies. Our platform supports both forex and CFD trading, allowing access to currency pairs, indices, commodities, and energy products. The diverse account options ensure traders can select conditions that align precisely with their risk profiles and capital availability.

MT4 Instant Account Configuration

Core Features and Specifications

The MT4 Instant account is designed for Pakistani traders looking for straightforward access to forex markets without commission fees. It features variable spreads starting at 1.8 pips on EUR/USD and instant execution, minimizing slippage risk. This account supports all major currencies, gold, and oil, with leverage up to 1:500. Negative balance protection is included to safeguard traders against unforeseen losses.

Platform Integration Details

MetaTrader 4 provides advanced charting tools with 30 technical indicators and the ability to install custom indicators. Automated trading is supported via Expert Advisors, which can run strategies without manual input. The MT4 mobile app ensures Pakistani traders can manage positions and monitor markets anywhere, syncing data seamlessly with desktop versions.

MT4 Market Account Structure

Commission-Based Trading Model

Our MT4 Market account introduces a commission system beneficial for Pakistani traders executing high-frequency or scalping strategies. Commissions are $3.50 per standard lot round turn, with spreads from 0.6 pips on top currency pairs. This method offers transparency by separating spreads from commissions, providing institutional-level pricing.

Advanced Trading Capabilities

This account permits micro-lot trading starting at 0.01 lots, fitting various capital sizes and risk preferences. Hedging is enabled, allowing simultaneous long and short positions on the same instrument. Market execution ensures trades fill at the best available price without requotes or price manipulation.

- Raw interbank spreads with separate commissions

- Direct market access and deep liquidity

- Execution optimized for scalping

- Flexible position sizing

- Support for hedging strategies

MetaTrader 5 Platform Options

Enhanced Market Access

The MT5 Instant account expands trading possibilities with access to forex, stocks, indices, and commodities through CFDs. It offers multiple order types, including market, pending, stop, and limit orders with advanced controls. Pakistani traders benefit from an integrated economic calendar displaying real-time updates relevant to their portfolios.

Programming and Automation Features

MQL5 language enables complex automated strategies with object-oriented features and sophisticated math functions. Strategy testers support multi-currency, multi-timeframe backtesting with tick-level data. This allows validation of trading systems using extensive historical information.

| Feature | MT4 Instant | MT4 Market | MT5 Instant | cTrader |

|---|---|---|---|---|

| Minimum Spread | 1.8 pips | 0.6 pips | 1.8 pips | 0.5 pips |

| Commission | None | $3.50/lot | None | $4.50/lot |

| Instruments | 70+ | 70+ | 100+ | 70+ |

| Execution | Instant | Market | Instant | Market |

cTrader Professional Platform

The cTrader account is tailored for professional Pakistani traders demanding advanced execution and transparency. It provides Level II market depth and ECN connectivity, offering real-time liquidity provider quotes. Commissions start at $4.50 per standard lot, with spreads from 0.5 pips on primary forex pairs.

Advanced order types like iceberg and hidden orders allow discreet trade execution for large volumes. The platform supports algorithmic trading using cBots coded in C#, offering improved performance and customization compared to traditional scripting.

- Level II pricing with market depth visibility

- ECN execution with direct market access

- Wide range of advanced order types

- Automated trading via C# cBots

- Integrated risk management tools

Pakistani traders also benefit from tools like guaranteed stop losses and position sizing calculators embedded in the interface, enhancing control over trade risk.

Account Funding and Withdrawal Methods

Local Payment Solutions

Our platform supports multiple deposit and withdrawal options designed for Pakistan. Bank wire transfers from major Pakistani banks such as HBL, UBL, and Allied Bank usually process within 1 to 3 business days. Card deposits through Visa and Mastercard are instant and secure.

Electronic wallets like Skrill and Neteller offer fast processing, typically within 24 hours. Pakistani traders can choose the method that best suits their timing and cost preferences.

- Bank wire transfers (1-3 business days)

- Visa and Mastercard (instant)

- Skrill wallet (24 hours)

- Neteller wallet (24 hours)

- Local bank transfers via partners

Withdrawal Processing Procedures

Withdrawal requests over $2,000 require additional verification, including identity and source of funds documentation. Our compliance team reviews requests within 24 hours on business days. Electronic wallets offer the fastest withdrawals, while bank transfers may take 3 to 5 business days.

Currency conversions use competitive interbank rates with transparent fees, ensuring Pakistani traders see detailed statements regarding charges and exchange rates applied.

Trading Conditions and Specifications

Leverage and Margin Requirements

Leverage depends on account type and traded instrument, with forex pairs offering up to 1:500 for retail clients in Pakistan. Professional clients may qualify for higher leverage based on assessments. Margin requirements adjust dynamically with account exposure, with alerts when margin levels approach 50%.

Overnight financing applies to positions held past 17:00 EST, calculated from interbank interest differentials. Swap credits or debits reflect currency pair and position direction.

Execution Quality and Speed

FxPro connects to multiple liquidity providers ensuring low latency and minimal slippage. Market orders execute on average within 13 milliseconds during active hours. Price improvement is applied automatically when possible to secure better fills.

Requotes are rare due to our market execution model and robust liquidity pools. Advanced routing algorithms maintain execution quality even during volatile periods.

| Trading Hours | Instrument Type | Leverage | Margin Call | Stop Out |

|---|---|---|---|---|

| 24/5 | Forex Majors | 1:500 | 50% | 20% |

| 24/5 | Forex Minors | 1:200 | 50% | 20% |

| Market Hours | Indices | 1:100 | 50% | 20% |

| Market Hours | Commodities | 1:100 | 50% | 20% |

Account Management and Support Services

Pakistani traders receive dedicated assistance through live chat, email, and phone support during trading hours. Our team provides technical help and account-related guidance promptly. Management tools include real-time reports, trade history, and performance dashboards for portfolio analysis.

Educational content is tailored to Pakistan’s economic context, covering PKR currency movements and local market factors. We provide insights on position sizing, stop-loss placement, and instrument correlation to help manage exposure effectively.

The account dashboard delivers comprehensive overviews, including profit/loss, margin usage, and pending orders. Mobile platform compatibility ensures continuous monitoring across Pakistan.

❓ FAQ

How do I open an FxPro account from Pakistan?

Register on the FxPro website, submit CNIC and address documents for verification, then choose your preferred account type to start trading.

Which FxPro account type suits beginners in Pakistan?

The MT4 Instant account offers commission-free trading with simple execution, ideal for novice traders focusing on forex pairs.

What payment methods are available for Pakistani traders?

Bank wire transfers, credit/debit cards, Skrill, Neteller, and local bank transfers are supported for deposits and withdrawals.

Can I use automated trading on FxPro platforms?

Yes, MT4 and MT5 support Expert Advisors, while cTrader allows algorithmic trading with cBots coded in C#.

What leverage can Pakistani traders access?

Leverage up to 1:500 is available on forex pairs, subject to account type and regulatory restrictions.