CFD Trading Strategies with FxPro Pakistan

Master CFD trading strategies with FxPro Pakistan using professional tools and real-time market analysis.

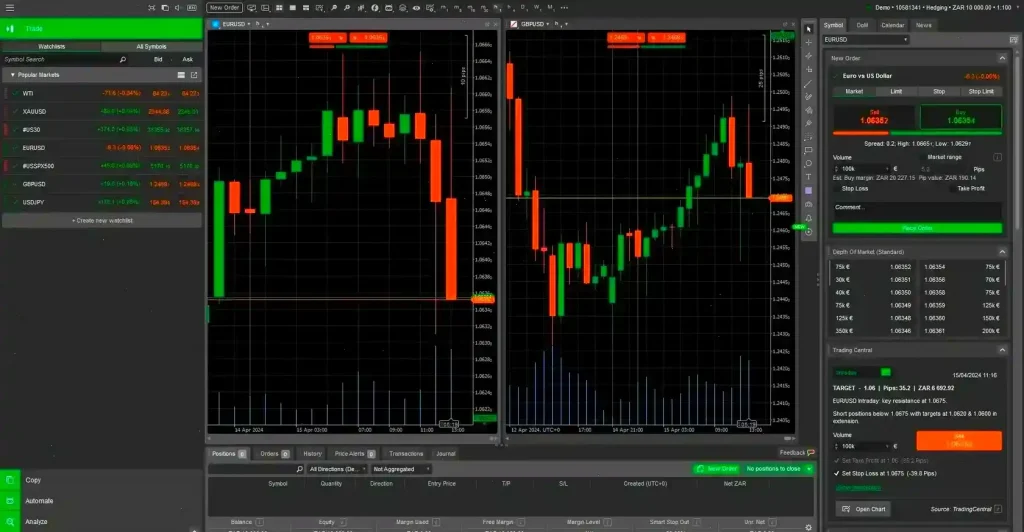

Professional CFD Trading Platform Access in Pakistan

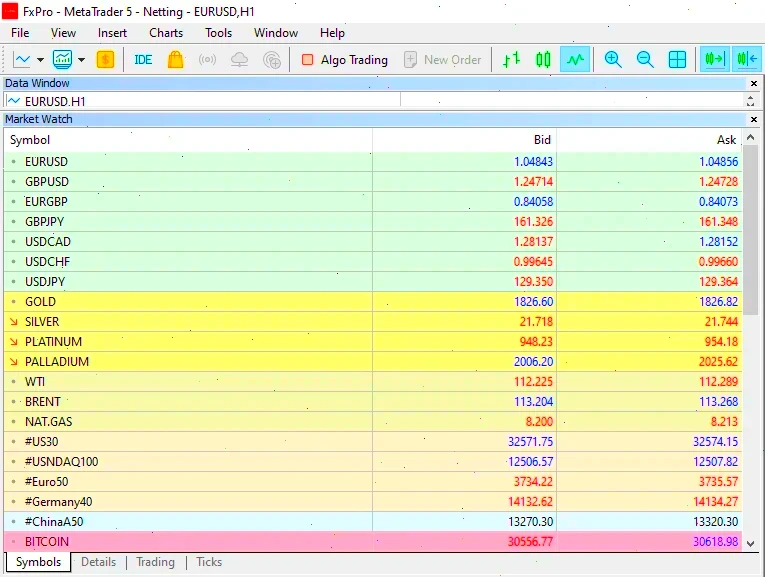

FxPro offers Pakistani traders direct access to a comprehensive CFD trading platform that supports indices, commodities, stocks, and currency pairs. Our platform is available via MetaTrader 4 and MetaTrader 5, providing fast execution with latency under 13 milliseconds for users in Pakistan. Real-time price feeds come from top liquidity providers, ensuring precise order execution across volatile markets. The platform also includes an automated risk management tool that calculates position sizes based on equity and user-defined risk settings. Spreads begin as low as 0.6 pips on major forex pairs, with access to over 2,100 tradeable instruments.

We provide multilingual interfaces including English and Urdu, and customer support is available during Pakistan Standard Time hours. The platform runs on Windows and Mac desktops, and mobile apps support Android 5.0+ and iOS 12.0+ devices. Our infrastructure guarantees 99.9% uptime with redundant data centers to maintain continuous connectivity.

| Platform Feature | Specification | Pakistan Availability |

|---|---|---|

| Execution Speed | <13ms average | Yes |

| Trading Instruments | 2,100+ CFDs | Full access |

| Minimum Deposit | $100 USD | PKR equivalent |

| Leverage Options | Up to 1:30 | EU regulations |

| Platform Languages | 20+ including Urdu | Yes |

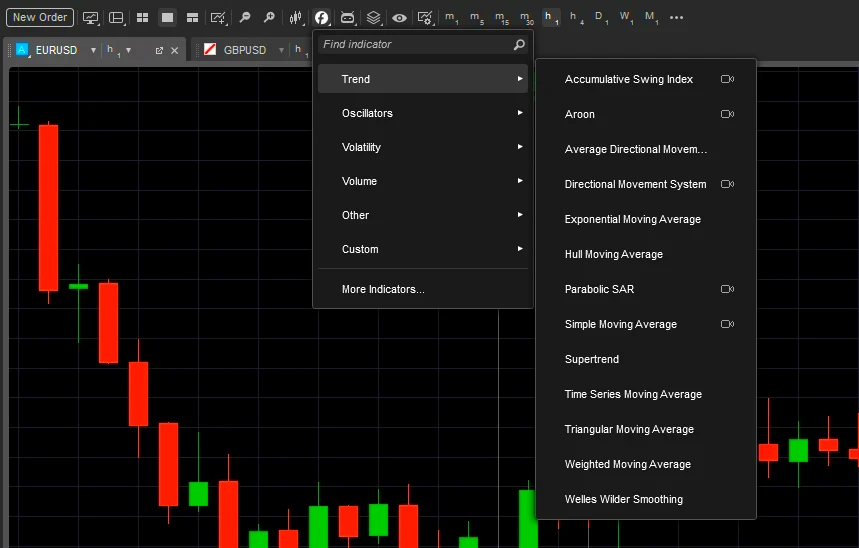

Advanced Technical Analysis Tools for CFD Strategies

Chart Analysis and Indicator Integration

Our platform integrates over 80 technical indicators that Pakistani traders can apply directly on charts to develop CFD trading strategies. Standard tools like Moving Averages, RSI, MACD, and Bollinger Bands are available alongside advanced indicators such as Ichimoku Kinko Hyo and Elliott Wave. Users can customize and display up to 100 charts simultaneously, facilitating multi-timeframe analysis.

Charting options include 21 timeframes from 1-minute to monthly, enabling scalping and long-term trading. Our proprietary algorithm automatically identifies support and resistance zones, aiding strategic entry and exit decisions. Traders in Pakistan can save unlimited custom templates and share analyses via social trading features.

Real-Time Market Scanning Capabilities

We provide a powerful market scanner that filters CFDs based on technical and fundamental criteria. The tool evaluates over 50 parameters such as volume surges, breakouts, and momentum shifts. Pakistani traders can create custom filters targeting sectors or regions within the CFD universe.

Alerts are delivered via email, SMS, and push notifications when conditions match user-defined criteria. The scanner refreshes every 15 seconds during active market hours and stores historical scan data for backtesting strategy effectiveness.

Risk Management Framework for Pakistani CFD Traders

FxPro incorporates a robust risk management system tailored for CFD trading strategies in Pakistan’s market. The platform calculates maximum position sizes considering account equity, instrument volatility, and trader risk thresholds. Stop-loss orders are automatically executed within 2 pips of target levels to avoid slippage during high volatility.

Our portfolio heat map visually represents real-time profit and loss across open positions. Correlation tracking between CFDs alerts traders when exposure concentration exceeds safe limits. Additional risk metrics include Value at Risk (VaR) and maximum drawdown projections for any active strategy.

Margin monitoring sends proactive alerts as equity approaches margin call levels. Partial position closing is supported, allowing profit locking while maintaining market exposure. Negative balance protection guarantees retail Pakistani clients never lose more than their account balance.

- Automatic stop-loss within 2 pips

- Real-time margin calculation

- Portfolio correlation alerts

- Drawdown and position limit notifications

- Negative balance protection

Strategy Backtesting and Performance Analysis

Historical Data Access and Testing Environment

Pakistani traders can backtest CFD strategies using our platform’s extensive historical tick data spanning 10 years. The testing environment replicates market conditions including spreads, commissions, and slippage based on historical volatility. Separate databases simulate different market sessions to reflect liquidity variations.

The backtesting engine processes up to one million data points per run, producing detailed reports within 30 seconds. Users can test strategies across multiple timeframes and market cycles. Corporate actions like dividends and stock splits are incorporated for equity CFD accuracy.

Performance Metrics and Strategy Optimization

We provide over 40 performance metrics, including Sharpe ratio, max drawdown, profit factor, and win rate. The optimization tool tests parameter variations automatically to identify optimal settings. Monte Carlo simulations assess robustness across thousands of scenarios, while walk-forward analysis validates out-of-sample performance.

Live performance tracking compares actual results to backtested outcomes, aiding ongoing strategy refinement. Reports can be exported in PDF or Excel formats.

| Performance Metric | Calculation Method | Interpretation |

|---|---|---|

| Sharpe Ratio | (Return – Risk-free rate) / Std. deviation | Risk-adjusted returns |

| Maximum Drawdown | Largest peak-to-trough decline | Worst-case loss |

| Profit Factor | Gross profit / Gross loss | Profitability measure |

| Win Rate | Winning trades / Total trades | Success rate |

| Average Trade | Net profit / Number of trades | Per-trade expectancy |

Automated Trading System Implementation

FxPro supports algorithmic and Expert Advisor (EA) trading for Pakistani users via MetaTrader 4 and 5. Our servers execute automated orders with latency below 10 milliseconds, essential for scalping and high-frequency strategies. The platform supports MQL4 and MQL5 programming languages, complete with development guides and sample code.

Traders can create custom indicators and scripts using the integrated development environment, which includes debugging and optimization tools. We offer VPS hosting optimized for automated trading, providing 24/7 uptime with redundant internet and power supply.

Multiple automated strategies can run concurrently on one account, each with independent risk parameters. Safeguards prevent excessive position sizing and runaway algorithms. Detailed logs of algorithmic trades are maintained for analysis and compliance.

- Sub-10ms execution latency

- MQL4/MQL5 programming support

- Integrated development and debugging

- 24/7 VPS hosting with high uptime

- Multi-strategy management

Market Analysis and Economic Calendar Integration

Fundamental Analysis Tools and Data Sources

Our platform aggregates real-time economic data from leading financial news providers, delivering relevant updates directly to Pakistani traders. The economic calendar highlights upcoming events with impact ratings, forecasts, and actual results. We provide sector-specific fundamental data including earnings announcements, commodity reports, and central bank communications.

Traders receive alerts before high-impact events affecting their positions or watchlists. Daily market commentary focuses on CFD trading opportunities during Asian and European sessions, tailored for Pakistan.

Sentiment Analysis and Market Positioning Data

Real-time client sentiment indicators display the ratio of long versus short positions on major CFDs, helping traders identify potential reversals. Sentiment gauges update every minute during trading hours. Institutional positioning data reveals smart money flows across asset classes, with trend shifts highlighted for early detection.

Pakistani traders can overlay sentiment data on price charts for enhanced timing of entries and exits.

Mobile Trading and Cross-Platform Synchronization

Our native mobile apps for Android and iOS provide full CFD trading capabilities optimized for users in Pakistan. Mobile versions include advanced charting, technical indicators, and one-click order execution. Biometric security options such as fingerprint and face recognition protect account access.

Cross-platform synchronization automatically syncs chart layouts, watchlists, and preferences between desktop, web, and mobile versions. Traders can begin analysis on desktop and continue seamlessly on mobile without reconfiguration. Push notifications alert users to price moves, margin calls, and economic events.

Offline chart viewing stores up to 30 days of historical data for analysis without internet. Data compression minimizes mobile data usage without sacrificing real-time updates. In-app chat support is available 16 hours daily for Pakistani clients.

| Mobile Feature | Android Requirements | iOS Requirements |

|---|---|---|

| Operating System | Android 5.0+ | iOS 12.0+ |

| RAM Memory | 2GB minimum | 2GB minimum |

| Storage Space | 150MB available | 200MB available |

| Internet Connection | 3G/4G/WiFi | 3G/4G/WiFi |

| Biometric Support | Fingerprint/Face | Touch ID/Face ID |

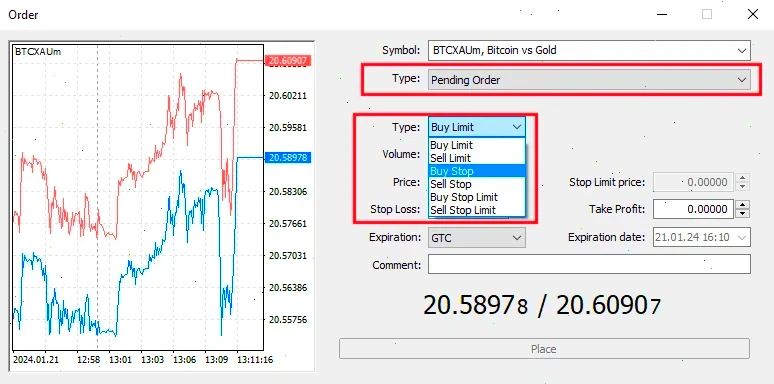

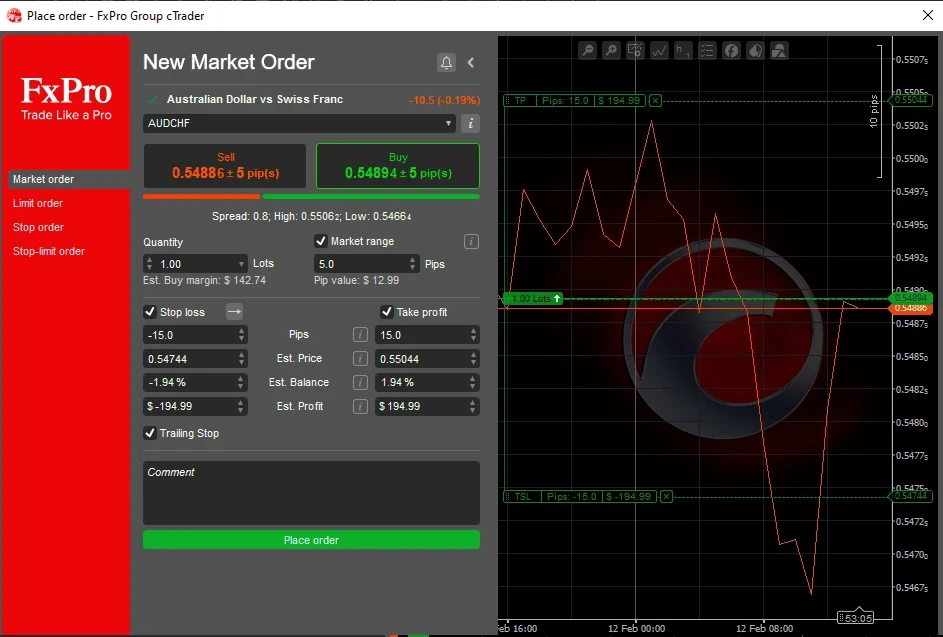

Advanced Order Types and Execution Strategies

Professional Order Management System

Our platform provides 14 order types, including market, limit, stop, trailing stop, One-Cancels-Other (OCO), and If-Done orders. Pakistani traders can automate complex position management strategies using these tools. Orders are routed via Smart Order Routing technology, selecting optimal prices from multiple liquidity providers.

Partial fills are supported to minimize market impact for large orders. Time-in-force options include Good-Till-Cancelled (GTC), Fill-or-Kill (FOK), and Immediate-or-Cancel (IOC). Scheduling orders for future execution based on time or market conditions is also possible.

Slippage Control and Execution Quality

The execution engine enforces maximum slippage limits, rejecting orders exceeding preset thresholds. Execution reports provide detailed statistics on slippage, order rejections, and fill speeds. Pakistani traders can access millisecond-accurate timestamps to evaluate order quality.

Monthly execution statistics are publicly available, showing average fill speeds and slippage by instrument. Requote protection rejects quotes far from market prices. Our algorithms prioritize price improvements, often filling orders better than requested limits.

- Smart Order Routing technology

- Maximum slippage enforcement

- Partial fill options

- Scheduled order execution

- Real-time execution quality monitoring

Pakistani traders using FxPro gain access to institutional-level execution, advanced analytics, and risk management tools. We continuously update our platform to support evolving CFD trading strategies in Pakistan’s dynamic financial environment.

| Order Type | Description | Use Case |

|---|---|---|

| Market Order | Instant execution at current price | Immediate entry or exit |

| Limit Order | Execution at specified price or better | Entry/exit at preferred levels |

| Stop Order | Triggered when price reaches stop level | Stop-loss or entry breakout |

| Trailing Stop | Stop-loss moves with price | Lock profits dynamically |

| OCO Order | One cancels other orders | Conditional position management |

❓ FAQ

How can Pakistani traders start using FxPro’s CFD platform?

Traders in Pakistan can register an account on FxPro, verify their identity, and deposit funds in PKR equivalent. Then, they download MetaTrader 4 or 5, log in, and begin trading CFDs using our platform’s tools and supported instruments.

What leverage is available for CFD trading in Pakistan?

FxPro offers leverage up to 1:30 for retail traders, complying with regional regulations. Professional traders may access higher leverage upon meeting specific criteria and verification.

Can I automate CFD trading strategies on FxPro in Pakistan?

Yes, FxPro supports algorithmic trading using Expert Advisors on MetaTrader platforms with VPS hosting available for 24/7 execution and low-latency order processing.

Which devices can I use to trade CFDs with FxPro in Pakistan?

You can trade CFDs on Windows and Mac desktops, via web browsers, or on mobile devices running Android 5.0+ and iOS 12.0+ with full feature synchronization across platforms.

Does FxPro provide tools for CFD trading strategy backtesting?

FxPro offers a comprehensive backtesting environment with 10 years of tick data, detailed performance metrics, and optimization features for Pakistani traders to refine their strategies.