FxPro Fee and Commissions

Understand FxPro trading costs in Pakistan. Compare spreads, commissions, and fees for forex and CFD trading on our platform.

Understanding Our Trading Cost Structure

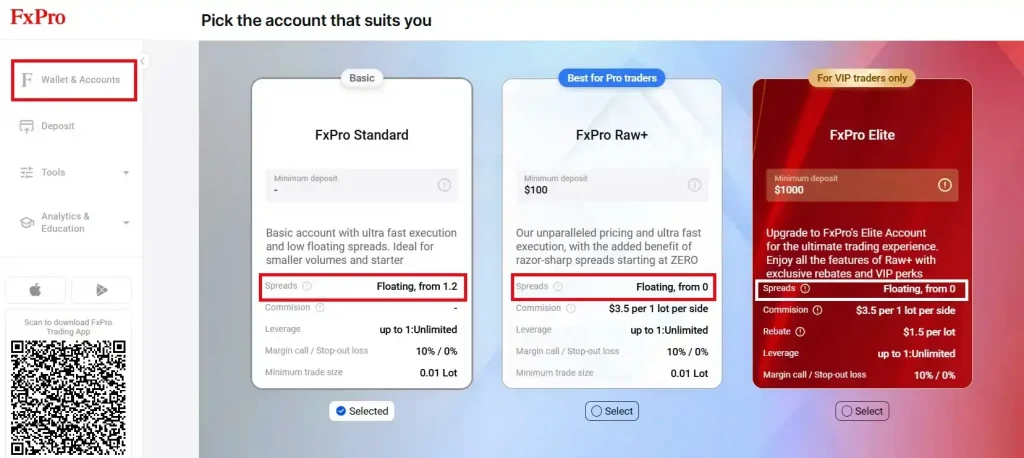

FxPro offers transparent pricing for traders in Pakistan, covering forex and CFD trading services. We provide multiple account types, each with tailored fee models including spreads and commissions. Clients can monitor fees in real-time via our platforms before executing trades. All costs are clearly itemized in account statements. Choosing the right account depends on your trading style and desired fee structure.

| Account Type | EUR/USD Spread | Commission per Lot | Minimum Deposit |

|---|---|---|---|

| Raw Spread | 0.1 pips | $7 | $100 |

| Market Execution | 1.8 pips | $0 | $100 |

| cTrader | 0.2 pips | $4.5 | $100 |

Forex Trading Costs in Pakistan

Major Currency Pair Spreads

Our platform delivers competitive spreads on major currency pairs. For EUR/USD, spreads start at 0.1 pips on Raw Spread accounts and 1.8 pips on Market Execution accounts. Spreads for GBP/USD and USD/JPY vary based on account type but remain within narrow ranges. The system updates spreads every millisecond, ensuring Pakistani traders get accurate market prices.

Exotic Currency Pair Pricing

Pairs involving the Pakistani rupee or emerging currencies have wider spreads due to liquidity factors. USD/PKR typically trades with spreads between 15 and 25 pips. We aggregate price feeds from Pakistani banks and international sources to provide consistent pricing. Cross-currency pairs like EUR/GBP also have variable spreads depending on volatility.

How to Monitor Forex Fees on FxPro

Pakistani traders can view live spread and commission data directly on FxPro’s platforms. Before placing orders, the estimated FxPro fee and commissions appear in the trade confirmation window. Use the platform’s trade history to review past costs by instrument and date. This transparency helps manage trading expenses effectively.

CFD Trading Fees Structure

FxPro supports CFD trading on indices, commodities, stocks, and cryptocurrencies, with tailored fees for each asset class. Stock CFDs carry commissions starting at 0.1% per trade, while index and commodity CFDs rely on spread-only pricing. Overnight fees apply for leveraged positions held past market close.

- Stock CFDs: commissions from 0.1% with minimum charges

- Index CFDs: spreads only, no commission

- Commodity CFDs: tight spreads with overnight financing

- Cryptocurrency CFDs: higher commissions due to volatility

- Access to over 2000 global stock CFDs

Pakistani traders can select instruments and review detailed fee schedules within FxPro’s trading interface. The commission calculator provides precise cost estimates before trading.

| Instrument Type | Commission Rate | Minimum Charge | Maximum Charge |

|---|---|---|---|

| US Stocks | 0.1% | $10 | $50 |

| UK Stocks | 0.1% | £8 | £40 |

| Index CFDs | Spread Only | N/A | N/A |

| Commodities | Spread Only | N/A | N/A |

Commission Calculation Methods

Per-Lot Commission Structure

Our Raw Spread and cTrader accounts apply fixed commission rates per standard lot traded. Commissions vary by instrument and account type, charged on both trade entry and exit. Mini and micro lots incur proportional fees. Pakistani traders benefit from volume rebates reducing commission costs automatically.

Percentage-Based CFD Commissions

Stock CFDs use percentage-based commissions calculated on trade value with minimum fees applied. We provide commission calculators in the platform for real-time cost previews. Promotions may offer commission-free periods for new Pakistani clients.

Steps to View Commissions on FxPro Platform

To check commission details, log into your FxPro account and open the trading terminal. Select the desired instrument and click on its contract specifications. Commissions and spreads display clearly along with overnight fees. Use the built-in calculators to estimate potential costs before trading.

Overnight Financing Charges

Positions held past daily rollover incur overnight financing fees. These depend on the instrument’s underlying interest rates and our administrative margins. Pakistani traders can view financing rates updated weekly on the platform. Long currency positions may earn positive rollover interest, while shorts typically incur fees.

- Forex pairs: LIBOR plus or minus margin rates

- Stock and index CFDs: reference rates plus fees

- Commodity CFDs: adjusted for market volatility

- Financing fees calculated daily and displayed in real-time

- Positions closed before daily cutoff avoid charges

| Instrument Type | Financing Rate | Frequency |

|---|---|---|

| Major Forex Pairs | LIBOR ± 2.5% annually | Daily |

| Minor Forex Pairs | LIBOR ± 3.5% annually | Daily |

| Stock CFDs | Reference Rate ± 2.5% annually | Daily |

| Index CFDs | Reference Rate ± 2.5% annually | Daily |

| Commodity CFDs | Reference Rate ± 3.0% annually | Daily |

Deposit and Withdrawal Fee Structure

Pakistani Payment Method Costs

We support multiple deposit options for clients in Pakistan, including bank transfers, cards, e-wallets, and cryptocurrencies. Bank wire deposits are free on our side but may incur intermediary bank fees. Card deposits process instantly without platform charges. E-wallets like Skrill and Neteller apply standard fees as per their policies.

Withdrawal Processing Fees

Withdrawal fees vary by method and amount. Bank wire withdrawals below $500 attract a $25 fee, waived for larger sums. Credit card withdrawals carry no processing costs. Cryptocurrency withdrawals incur blockchain network fees between $5 and $50 depending on congestion. Withdrawals generally process within 24 hours on business days.

| Withdrawal Method | Processing Fee | Processing Time | Minimum Amount |

|---|---|---|---|

| Bank Wire | $25 (under $500) | 2-5 business days | $50 |

| Credit Card | Free | 3-5 business days | $10 |

| E-wallets | Provider rates | 24 hours | $10 |

| Cryptocurrency | Network fees | 24 hours | $25 |

Account Maintenance and Inactivity Fees

Inactive accounts without trades or deposits for 12 months incur a $5 monthly administration fee. Pakistani clients receive prior email alerts before fees apply. Accounts with balances below $10 are exempt. Activity resets inactivity timers, and educational or demo accounts remain fee-free. The client portal provides clear visibility of any pending fees.

Managing Inactivity Charges

To avoid inactivity fees, maintain regular trading or funding activity. Notifications remind clients of inactivity status. Fee reversals can be requested within 30 days if justified. Our support team assists Pakistani traders with account management.

Cost Optimization Strategies for Pakistani Traders

Minimizing FxPro fee and commissions is possible by selecting suitable account types and trading during high liquidity periods. Raw Spread accounts offer lower spreads but include commissions, ideal for frequent traders. Market Execution accounts suit traders who prefer commission-free trading despite wider spreads.

- Choose account types based on trading volume and style

- Trade during Asian sessions for tighter spreads

- Utilize monthly volume discounts and rebates

- Avoid trading during major news releases

- Use FxPro’s cost calculators to plan trades

Our platform provides monthly cost analysis reports to help Pakistani traders optimize expenses. Educational resources cover advanced fee management techniques.

| Optimization Method | Benefit | Implementation |

|---|---|---|

| Account Type Selection | Reduce spreads or commissions | Choose Raw Spread or Market Execution |

| Trading Hours | Lower spread costs | Trade during Asian sessions |

| Volume Discounts | Lower commission rates | Increase monthly trading volume |

| Rebate Programs | Cashbacks on fees | Join VIP or introduce brokers |

| Cost Calculators | Estimate expenses | Use built-in FxPro tools |

❓ FAQ

What is the typical FxPro fee and commissions structure for Pakistani traders?

FxPro applies spreads and commissions based on account type. Raw Spread accounts charge $7 per lot plus tight spreads. Market Execution accounts have wider spreads but no commission. CFD commissions vary by instrument, starting at 0.1% for stocks.

How can traders in Pakistan view their trading fees before placing orders?

FxPro platforms display exact fees, including spreads and commissions, in the order confirmation window. Traders can also access contract specifications and use built-in calculators to preview total costs.

Are there fees for deposits and withdrawals in Pakistan?

Deposits via bank wire and cards are free from FxPro charges, though intermediary fees may apply. Withdrawals under $500 via bank wire incur a $25 fee. Other methods have variable fees detailed in the client portal.

Does FxPro charge inactivity fees for Pakistani accounts?

Yes, accounts inactive for 12 months are charged $5 monthly. Notifications are sent before fees apply. Activity or funding resets the inactivity timer, and accounts below $10 balance are exempt.

What strategies help reduce trading costs on FxPro in Pakistan?

Pakistani traders can select appropriate account types, trade during high liquidity sessions, increase monthly volume for discounts, and use FxPro’s calculators and rebate programs to minimize fees.