FxPro Registration Pakistan

Register with FxPro in Pakistan quickly. Complete verification, access forex and CFD trading with competitive spreads and fast execution.

Account Opening Requirements for Pakistani Traders

Our company facilitates Pakistani residents to open trading accounts following a clear and compliant registration protocol. We require valid identification aligned with Pakistani and global financial regulations. Traders must submit CNIC with visible front and back sides or a Pakistani passport as an alternative. Address proof includes recent utility bills, bank statements, or official documents dated within three months. Proof of income through salary certificates, tax returns, or business licenses is also necessary for verification.

We ensure verification completion within 24-48 hours on working days. Our strict adherence to regulatory standards protects your funds and data integrity.

| Document Type | Accepted Formats | Processing Time |

|---|---|---|

| CNIC | Front/Back sides, clear photo | 24 hours |

| Address Proof | Utility bill, bank statement | 24 hours |

| Income Proof | Salary certificate, tax returns | 48 hours |

Step-by-Step Registration Process

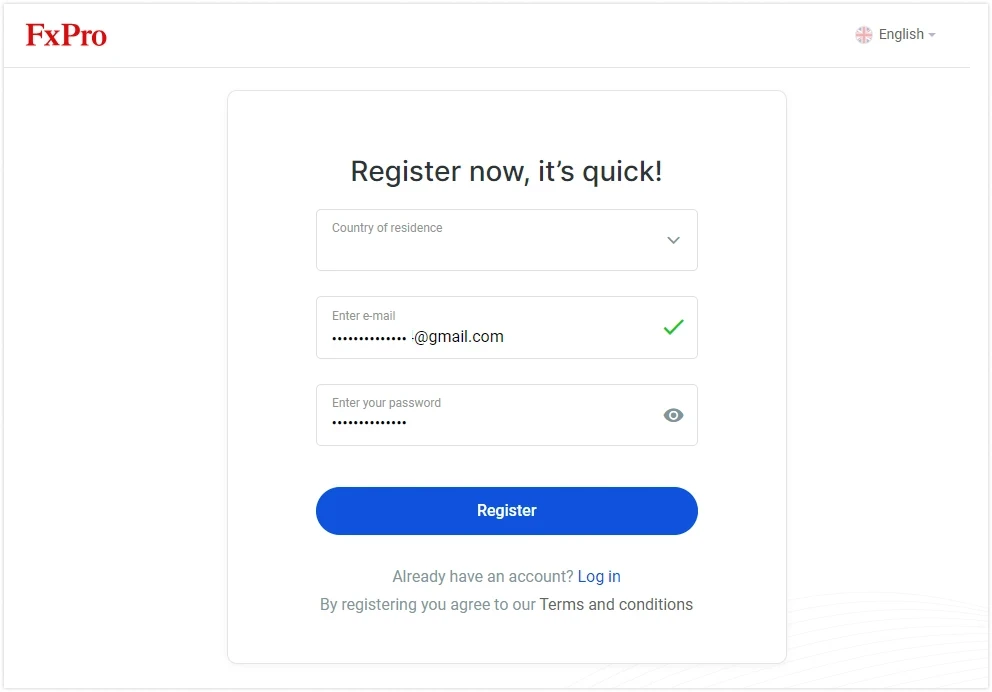

Initial Account Setup

Visit FxPro’s official website and click the “Open Account” button on the homepage. Select Pakistan as your country to configure local currency and regulatory settings. Enter a valid email and create a secure password with mixed characters and symbols. Provide your Pakistani mobile number with the +92 country code for SMS verification.

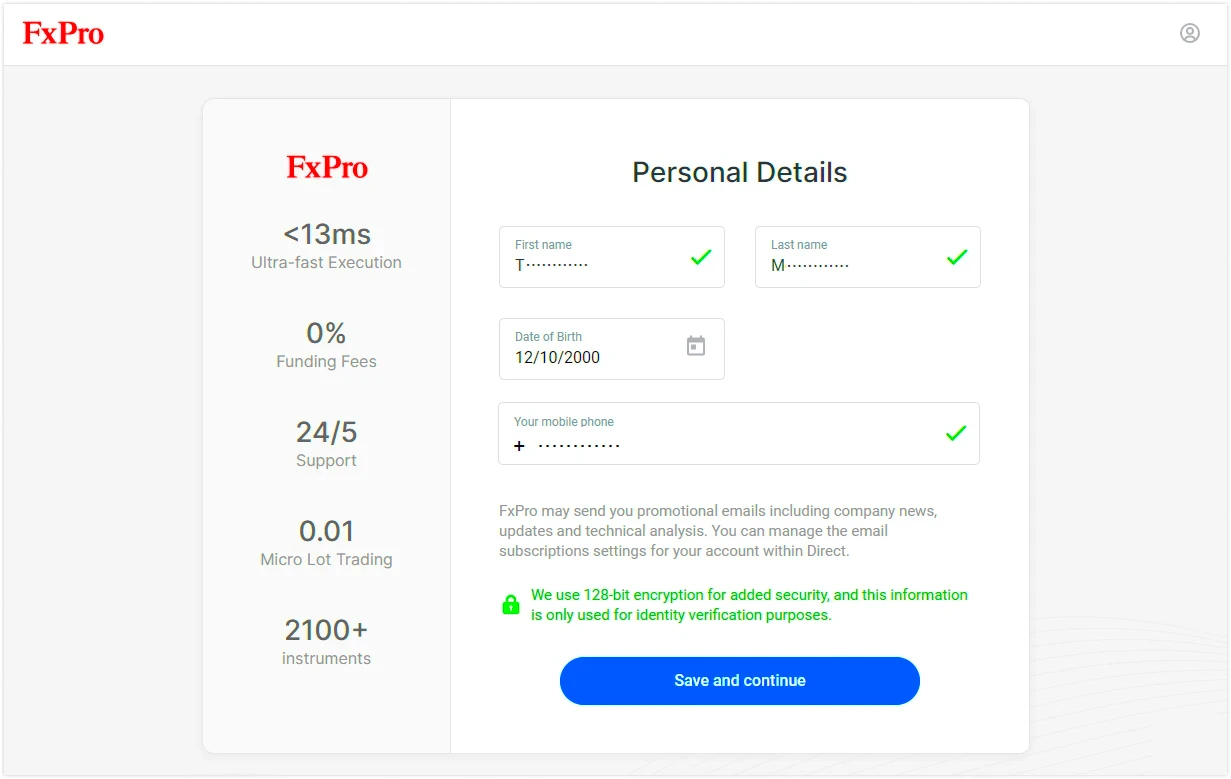

Personal Information Entry

Fill in your personal details exactly as per your CNIC or passport. Include your full name, date of birth in DD/MM/YYYY format, and Pakistani nationality. Additional fields such as gender, marital status, and dependents are required for compliance and risk assessment.

Document Verification Requirements

Identity Verification Process

Upload clear images of your CNIC’s front and back sides in JPEG, PNG, or PDF format, each under 5MB. Submit a selfie holding your CNIC to confirm your identity. Our system automatically scans and verifies the documents, ensuring compliance with anti-fraud measures.

Address and Income Verification

Provide recent utility bills or bank statements from Pakistani institutions dated within 90 days. Upload employment certificates, salary slips, or business licenses for income verification. Self-employed clients must submit valid tax documents or licenses. Our team reviews submissions manually to guarantee regulatory adherence.

Required documents include:

- CNIC front and back (mandatory)

- Recent utility bill or bank statement (proof of address)

- Employment certificate or business registration (income proof)

- Pakistani passport (alternative ID)

- Tax identification number for enhanced verification

Trading Account Configuration

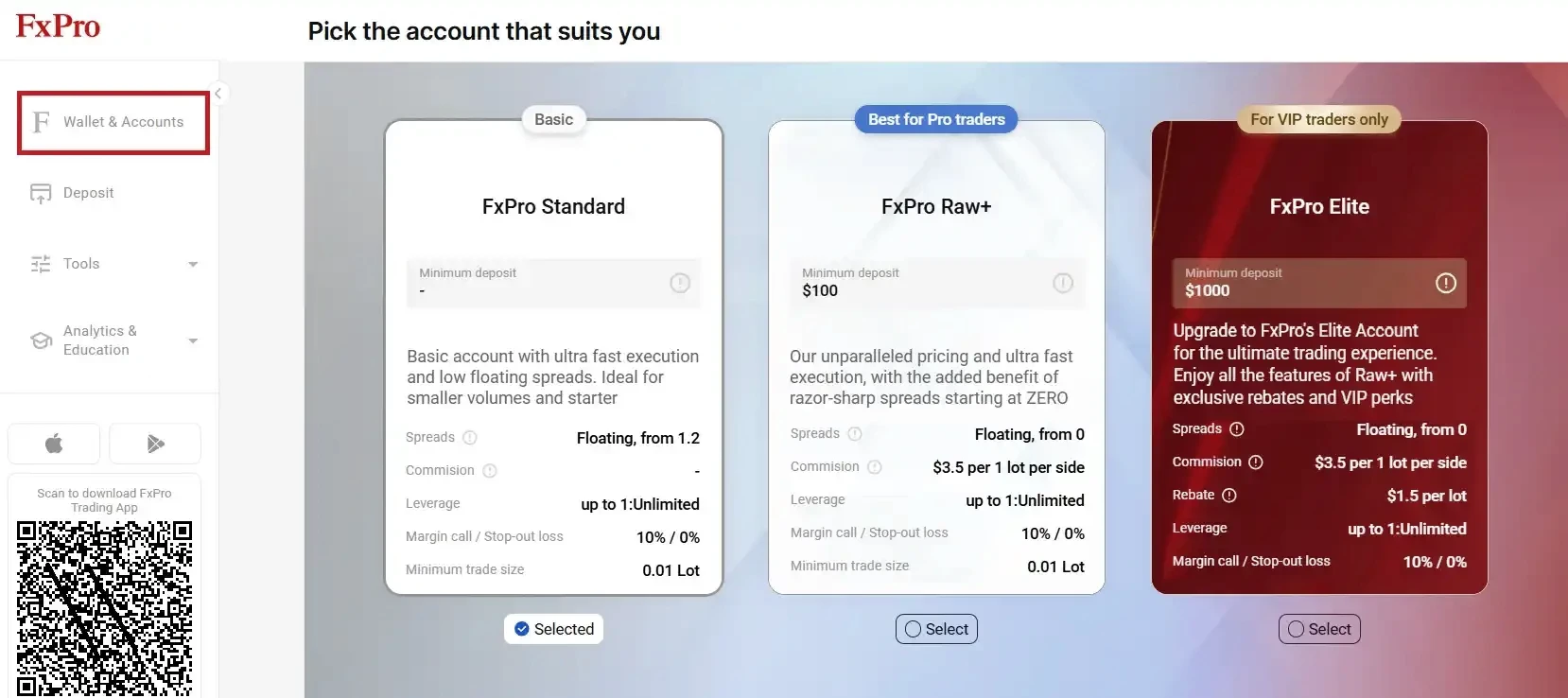

Account Type Selection

Choose from Standard, Professional, and Islamic accounts tailored for Pakistani traders. Standard accounts start with spreads from 1.2 pips on popular pairs without commissions. Professional accounts offer spreads from 0.1 pips with $3.50 commission per lot, ideal for active traders. Islamic accounts comply with Sharia law by removing swap fees.

Platform and Currency Settings

Select your preferred platform: MT4, MT5, or cTrader, each providing unique analytical tools and trading features. Set your base currency to USD, EUR, or GBP, impacting deposit and withdrawal procedures. Adjust leverage up to 1:500 for forex and according to instrument categories.

| Account Type | Minimum Deposit | Spreads | Commission |

|---|---|---|---|

| Standard | $100 | From 1.2 pips | None |

| Professional | $500 | From 0.1 pips | $3.50/lot |

| Islamic | $100 | From 1.2 pips | None |

Funding Your Trading Account

Available Deposit Methods

Pakistani clients may deposit funds via bank wire transfers, local credit/debit cards, and e-wallets. Supported Pakistani banks enable direct wire transfers, processed within 1-3 business days. Visa and Mastercard credit cards from Pakistan process deposits instantly. Electronic wallets like Skrill, Neteller, and Perfect Money offer rapid funding with competitive currency conversion.

Deposit Processing and Limits

Minimum deposits start at $100, accommodating various budget levels. Maximum limits vary depending on verification status and payment method. We charge no deposit fees; however, banks or payment providers may apply standard charges. Currency conversions use live interbank rates with minimal spread.

| Deposit Method | Processing Time | Notes |

|---|---|---|

| Bank Wire Transfer | 1-3 business days | Supported Pakistani banks |

| Credit/Debit Card | Instant | Visa, Mastercard |

| Skrill | Instant | Electronic wallet |

| Neteller | Instant | Electronic wallet |

| Perfect Money | Instant | Electronic wallet |

Trading Platform Access and Features

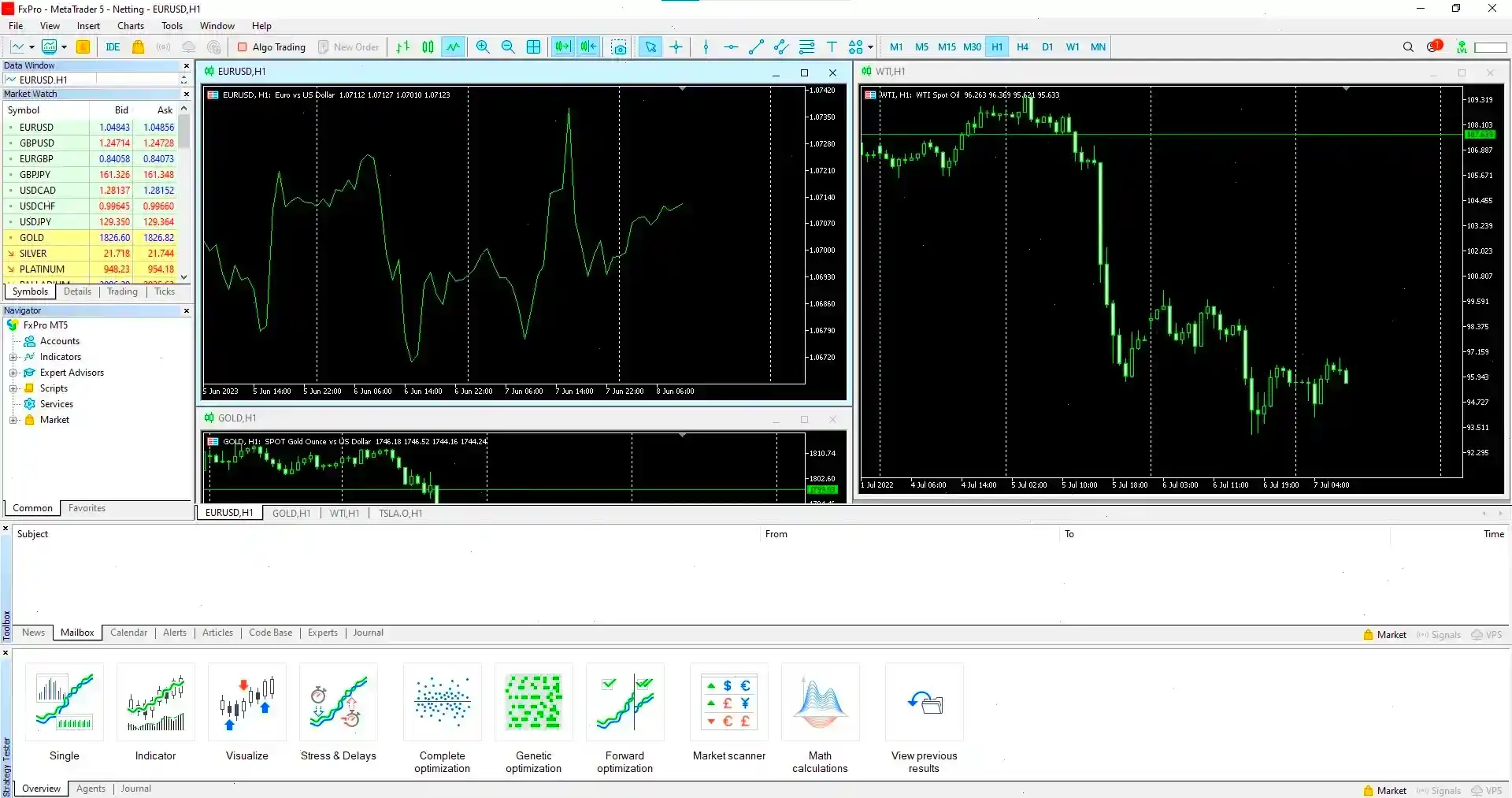

MetaTrader 4 and 5 Capabilities

MT4 and MT5 platforms provide over 50 technical indicators, multiple chart timeframes, and real-time quotes on 200+ instruments. Pakistani traders benefit from Expert Advisors (EAs) allowing automated strategies with backtesting. Mobile apps for Android and iOS enable trading on the move with push notifications for market alerts.

cTrader Platform Advantages

cTrader supports advanced order types such as stop-limit, trailing stops, and partial closures. Level II pricing reveals market depth and liquidity. Algorithmic trading is enabled via cBots programmed in C#, with access to API documentation for custom development. One-click execution and risk management tools optimize trading performance.

| Platform | Instruments | Mobile App | Automated Trading |

|---|---|---|---|

| MT4 | 200+ | Yes | Expert Advisors |

| MT5 | 200+ | Yes | Expert Advisors |

| cTrader | 200+ | Yes | cBots |

Available Trading Instruments

Forex Currency Pairs

Our platform offers 70+ currency pairs, including majors like EUR/USD and GBP/USD with spreads from 0.1 pips on professional accounts. Exotic pairs involving PKR may be accessible depending on market conditions. Cross-currency pairs allow trades without USD involvement. Pricing updates every millisecond, ensuring precise market data.

CFD Trading Options

We provide CFDs on global stocks from NYSE, NASDAQ, LSE, and Asian markets, enabling Pakistani traders to access equity markets without ownership. Commodities include gold, silver, crude oil, and agricultural products, facilitating portfolio diversification. Index CFDs cover major indices such as S&P 500 and FTSE 100 with leverage up to 1:100.

Customer Support and Account Management

Support Channels for Pakistani Traders

Our support operates 24/5 with multilingual assistance including English and Urdu. Live chat offers instant response for technical or trading concerns. Email inquiries receive replies within 4 hours on business days. Phone support connects you to dedicated account managers. We provide webinars and tutorials adapted to Pakistani market specifics.

Account Security Measures

Two-factor authentication via SMS codes protects account access using your registered Pakistani mobile number. All data transfers use SSL encryption. Client funds are segregated in tier-1 banks, ensuring security and compliance. Regular audits maintain adherence to international and Pakistani regulations.

| Support Type | Availability | Details |

|---|---|---|

| Live Chat | 24/5 | English and Urdu |

| Within 4 hours | Business days | |

| Phone Support | 24/5 | Account Managers |

| Educational Resources | On demand | Webinars, tutorials |

| Security | Continuous | 2FA, SSL, fund segregation |

❓ FAQ

What documents are required for FxPro registration in Pakistan?

Pakistani traders must provide CNIC or passport, recent utility bills or bank statements for address verification, and proof of income such as salary certificates or business licenses.

How long does FxPro verification take for clients in Pakistan?

Document verification usually completes within 24 to 48 hours on business days.

Which deposit methods are available for Pakistani traders?

Pakistani clients can fund accounts via bank wire transfers, Visa/Mastercard credit cards, and e-wallets like Skrill, Neteller, and Perfect Money with mostly instant processing times.

Can Pakistani traders use leverage on FxPro?

Yes, leverage up to 1:500 is available on forex pairs, with other instruments offering different leverage ratios.

What trading platforms does FxPro support in Pakistan?

Our platform offers MetaTrader 4, MetaTrader 5, and cTrader, each with mobile apps and automated trading capabilities.